Fundamentally Speaking

History of Sep-Dec Corn Spread vs. Aug Stocks-to-Use Ratio

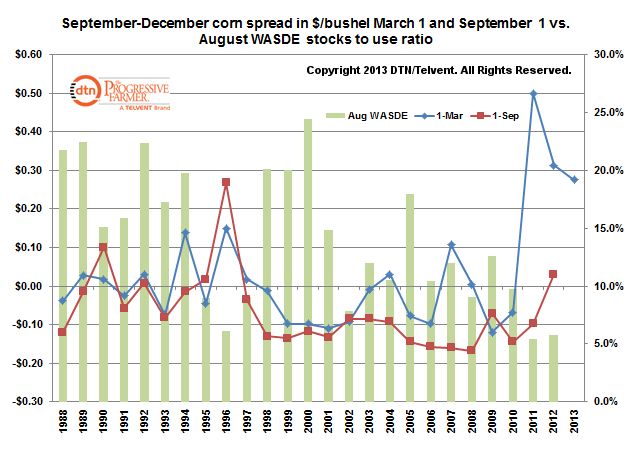

The 2013 September-December corn spread as of March 1 came in at $0.2750 premium to the September contract and that appears to be the third highest inverse ever next to the $0.3125 spread last year and the peak of a $0.50 inverse back on March 1, 2011 for the Sep-Dec 2011 spread.

It is interesting that the prior two years have seen a higher inverse even though the latest stocks to use ratio is the tightest ever.

The prior peak was seen back on March 1, 1996 at $0.15 for the Sep-Dec 1996 spread, a year very similar to now with the stocks to use also very tight back then.

We were curious what this spread did over the next six months and were values after the August WASDE report which is when the first survey based crop production report is released.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This chart shows the September-December corn spread as of March 1 and September 1 and plots the August corn stocks to use ratio.

Keep in mind that while December is a new crop month, September is both for some early harvested corn can be delivered against the September contract especially if some early corn is available out of the Southeast and/or the southern Midwest harvest is particularly early.

On the other hand, a late start to plantings, a cool summer that prolongs the developmental process and the accumulation of growing degree days can have the September act more like a new crop contract.

Usually the Sep-Dec spread narrows in the six months between March 1 and September 1 for month times the new crop production is normal and there is less demand for the higher priced September.

Actually this spread seems to narrow whether the crop is large or small.

Last year, one of the worst droughts in history saw the spread narrow by $0.2825 and the season prior to that, also a short crop year saw the spread tumble by $0.60 per bushel and even in 1988 it lost $0.0825.

On the other hand, record crops such as seen in 1994 and 2004 also saw the spread narrow.

It appears that the spread widens when the crop is late making the September corn all the more valuable.

Such was the case in 2009, 2002, and 1995, all late harvest years.

With talk of large plantings in the south and demand remaining poor, the odds seem right that the spread between the September and December 2013 crops will be quite a bit narrower than the currently high 27 cent spread.

(KA)

© Copyright 2013 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .