Fundamentally Speaking

Soybean Use & Prices First Half of Year vs. Second

The recent pop in soybean futures has been attributed to ideas that prices need to remain at record levels in order to ration very tight supplies to insure that the U.S. has at least some pipeline supplies at the end of the marketing year August 30.

The current ending stocks of 125 million bushels for the 2012-13 season is one of the smallest ever and that figure as a percent of estimated usage of 3.080 billion bushels of 4.1% is the lowest on record.

The problem is that the USDA estimated use in the first quarter of the year (Sep-Nov) at 1.223 billion bushels and with ending stocks pegged at 125 million this means consumption for the rest of the year (Dec-Aug) has to come in at 1.841 billion bushels to keep the stocks at this bare-bones level.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In the 2011-12 season, soybean use in the Dec 2011-August 2012 period was 2,214 billion bushels. This means usage for the last 75% of this marketing year has to be pared back 373 million bushels.

That seems an extraordinarily difficult task given that usage the first quarter this year was 281 million above the Sep-Nov 2012 figure.

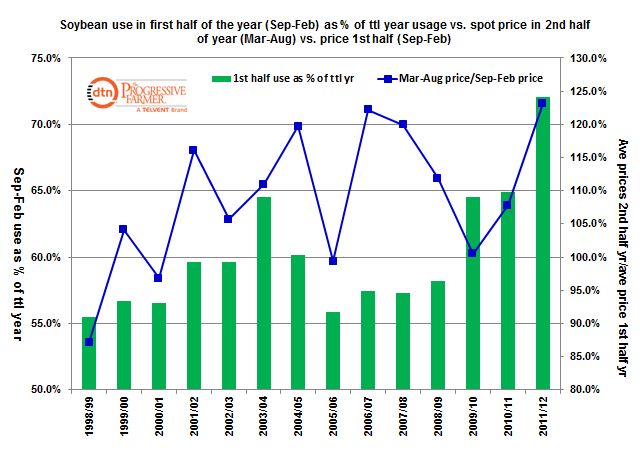

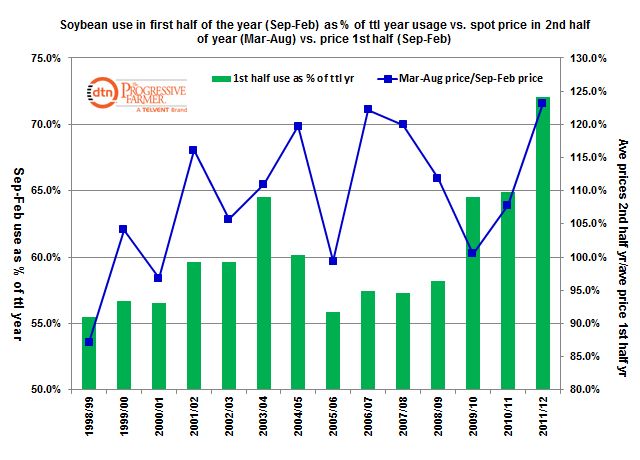

The accompanying chart shows the amount of soybeans used the first half of the marketing year (Sep-Feb) as a percent of total year’s consumption and in recent years, the amount used the first half of the year is far greater than the 55-60% rate seen in the past.

In the 2009/10 and 2010/11 seasons, soybean usage the first half of the marketing season was 65% of year’s total and that increased to 72% in the 2011-12 marketing season.

This means that high prices are needed to ration demand and in recent years the average of soybean prices the second half of the marketing year (Mar-Sep) have averaged higher than values the first half of the year (Sep-Feb).

In the 2012-13 season, soybean prices the second half of the year were 23% higher than the average first half of the year prices.

With the Sep 2012-Feb 2013 average soybean price coming in at $15.05, a similar increase would project the March 2013-Sep 2013 average spot soybean price at $18.51.

Not saying that values will trade that high but now more than ever a large South /American soybean crop has to be harvested and brought to the market fast.

(KA)

Comments

To comment, please Log In or Join our Community .