Technically Speaking

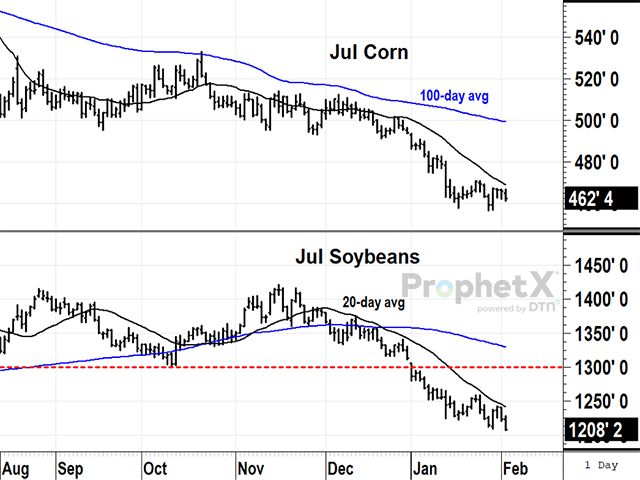

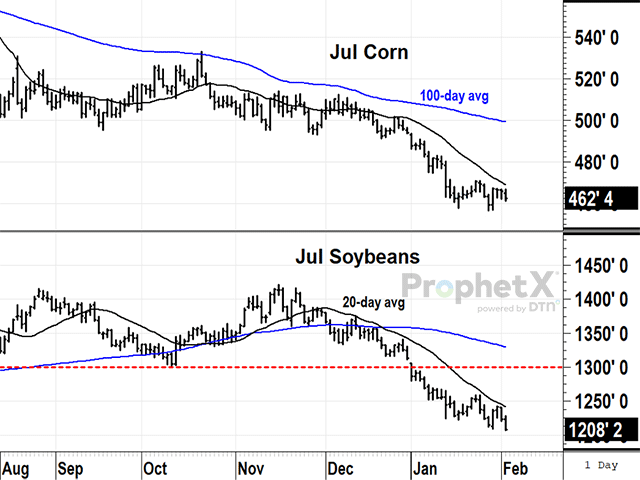

Summer Corn, Soybean Prices Elude Support

July corn closed at $4.62 1/2 Friday, Feb. 2, losing a penny during a quiet week of winter trading. July corn is near its lowest July prices in three years, well below USDA's estimated cost of production, near $5.00 a bushel, and so cheap commercials were holding 241,727 net longs on Jan. 30, close to the largest such position on record. With prices cheap and attracting commercial attention, the stage is set for prices to find long-term support, but so far, prices have not gotten the message and show no sign of turning higher yet. Prices have traded below the 20-day average since mid-December and made the most recent low of $4.56 1/2 on Jan. 29. In a normal bearish situation, hitting a three-month high at some point is reasonable, but the market needs an event to trigger short-covering among speculators. With prices trapped below the 20-day average at $4.69, there has been no threat to specs yet.

SOYBEANS:July soybeans closed at $12.08 1/4 Friday, down 15 3/4 cents for the week and over a dollar a bushel cheaper than prices started the new year. Friday's close was also the lowest close in over seven months, having traded below the 20-day average since Nov. 24, a time when rains returned to Brazil. The fact that prices are still reaching new low ground without an argument suggests prices have farther to go before significant support will be found. That is no small statement, knowing July prices are near their lowest levels in two years and commercials were net long 155,822 contracts, the largest vote of confidence on record.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A related bearish concern for U.S. soybean prices is the price of March FOB soybeans in Paranagua, Brazil, listed at the U.S. equivalent of $11.07 a bushel on Feb. 2. It is difficult at this point to know what might stop the bearish slide in soybean prices and I have to admit, like corn, there is no evidence of prices finding support yet.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .