Technically Speaking

March Corn, Chicago Wheat: Two Markets Looking For Support

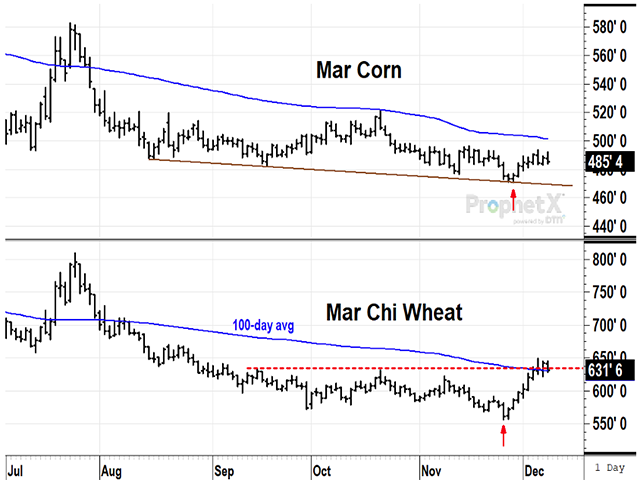

After a couple of ups and downs, March corn ended Friday, Dec. 8, at $4.85 1/2, a 3/4-cent gain on the week. USDA now estimates U.S. ending corn stocks at 2.13 billion bushels (bb), still the highest in five years. World ending corn stocks, excluding China, are estimated at a six-year high by USDA. The one bullish possibility for corn prices in early 2024 could be a weather problem in Brazil, but the safrinha crop is still months away from being planted.

Technically speaking, March corn prices have been slowly grinding lower, finding support at a lower channel line that most recently turned prices up from a low of $4.70 1/2 on Nov. 29. Prices have traded below the 100-day average since late July, a source of resistance that currently sits at $5.01. Long-term, there is reason to expect support for spot corn prices near $4.50, but March corn has not yet proven an ability to overcome resistance.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

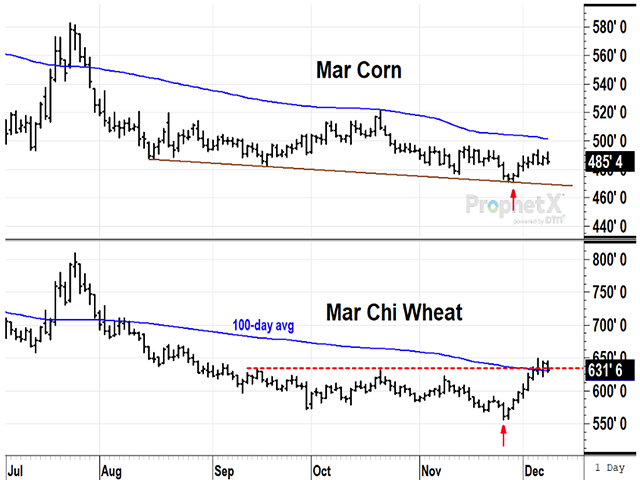

After a week that saw 41 million bushels (mb) of U.S. SRW wheat sold to China and watched USDA reduce its estimate of U.S. ending SRW wheat stocks from 148 mb to 118 mb in 2023-24, March Chicago wheat settled at $6.31 3/4 Friday, up 29 cents on the week, and showing a nice rebound from last week's low of $5.56 1/4. Friday's close was also the highest in three months, completed the highest weekly gain since July, and was slightly above the 100-day average at $6.30.

Fundamentally, U.S. wheat prices probably still have a tough road ahead, but technically speaking, $6.00 was the old line of resistance in spot Chicago wheat from late 2014 to early 2020 and there is good reason to expect long-term support has finally been reached. The willingness to sustain trading in March Chicago wheat above the 100-day average at $6.30 will be encouraging if the market can pull it off. China has already bought more wheat from the U.S. in the first half of 2023-24 than it did all last season and may not be done yet with winter ahead.

**

The comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .