Technically Speaking

Monthly Analysis: Grain Markets

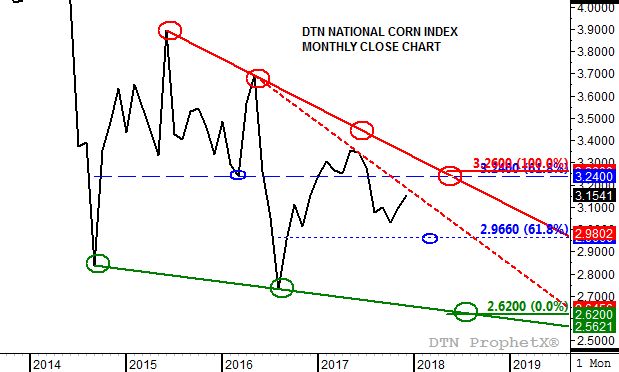

Corn (Cash): The DTN National Corn Index (NCI, national average cash price) closed at $3.15 1/2, up 5 1/2 cents for the month. The monthly close-only chart shows the NCI near trendline resistance at $3.18 3/4 heading into January. With the major (long-term) trend still down and the NCI secondary (intermediate-term) uptrend nearing an end, the projected March low monthly close near $2.97 still looks like a strong possibility.

Corn (Futures): The March contract closed at $3.50 3/4, down 5 cents on the monthly chart. The market's major (long-term) trend remains down. Support remains at $3.39, a price that marks the 76.4% retracement level of the rally from $3.15 (September 2016) through the high of $4.17 1/4 (July 2017). Nearby futures are expected to post a low in early spring before rallying again through the first-half of summer.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybeans (Cash): The DTN National Soybean Index (NSI, national average cash price) closed at $8.85 3/4, down 27 cents for the month. The NSI posted a bearish outside month during December, indicating cash soybeans could build major (long-term) downside momentum. Trendline support during January comes in at $8.69, with the 4-month low sitting at $8.60 1/2 (August 2017). The previous major low is at $8.05 from March 2016.

Soybeans (Futures): The March contract closed at $9.61 3/4, down 24 cents on the monthly chart. Similar to the NSI (DTN National Soybean Index, national average cash price), soybean futures posted a bearish outside month during December. Trendline support during January comes in at $9.21. The market's previous major (long-term) low is at $8.44 1/4 from November 2015.

HRW Wheat (Cash): The DTN National HRW Wheat Index (HW.X, national average cash price) closed at $3.76 1/2, up 12 1/2 cents for the month. The HW.X remains in a major (long-term) uptrend on its monthly close-only chat. Next resistance is up at $4.20 1/2, a price that marks 23.6% retracement level of the previous downtrend from $8.64 1/4 (September 2012) through the low of $2.83 1/2 (August 2016).

HRW Wheat (Futures): The March Kansas City (HRW) contract closed at $4.27 1/4, down 4 1/4 cents for the month. HRW wheat's major (long-term) trend remains sideways on its monthly chart. Support is at the major low of $3.95 (August 2016) while initial resistance is at the 4-month high of $4.60 1/4.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .