Technically Speaking

Weekly Analysis: Livestock Markets

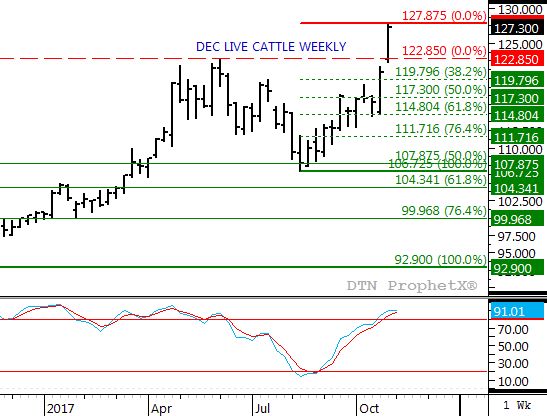

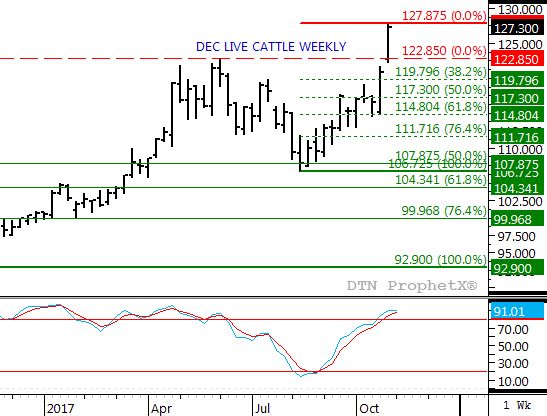

Live Cattle: The December contract closed $6.475 higher at $127.30. The contract posted a gap higher that could be viewed as short-term bullish, but possible intermediate-term bearish. Much will depend on this week's action, for if the contract comes under renewed pressure from commercial selling and falls through the week it could potential set up a two-month reversal and island-top. Weekly stochastics are above 80%, indicating an overbought market. The major (long-term) uptrend on the market's monthly chart continues to strengthen with a next upside target of $134.425.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feeder Cattle: The more active January contract closed $5.575 higher at $161.525. The contract's secondary (intermediate-term) uptrend continues to strengthen, leaving a small upside gap last week between $157.125 and $157.10. With weekly stochastics above 90% indicating a sharply overbought situation, the market is vulnerable to establishing a secondary top. However, the contract did close last Friday near its weekly high of $162.075 increasingly the likelihood of a new high early this week.

Lean Hogs: The December contract closed $0.65 higher at $66.10 last week. Despite the contract's higher weekly close, Friday's settlement could be considered bearish given its distance from the weekly high of $68.175. If selling interest intensifies this week the market could quickly fall back, hinting at a new secondary (intermediate-term) downtrend.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.07 1/4, up 1 3/4 cents for the week. For now the secondary (intermediate-term) trend could still be considered sideways. The NCI.X needs to see a weekly close above its previous high weekly close of $3.08 1/2 to indicate a move into a normal seasonal uptrend that tends to last through early June (for more information, see last Friday's Newsom on the Market column "Knowing When to Walk Away").

Soybean meal: The December contract closed $1.80 higher at $313.90. The contract looks to be in secondary (intermediate-term) and major (long-term) sideways trends. Support this month on the long-term monthly chart is calculated at $309.20 while resistance is at $346.20.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .