Technically Speaking

Weekly Analysis: Livestock Markets

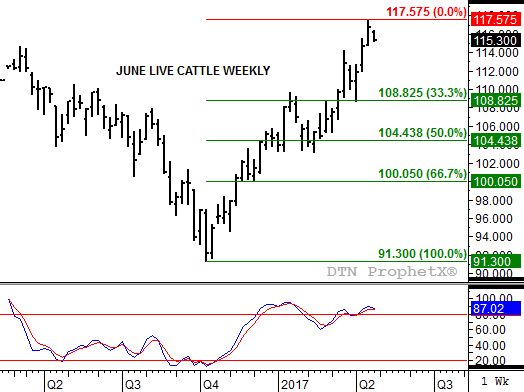

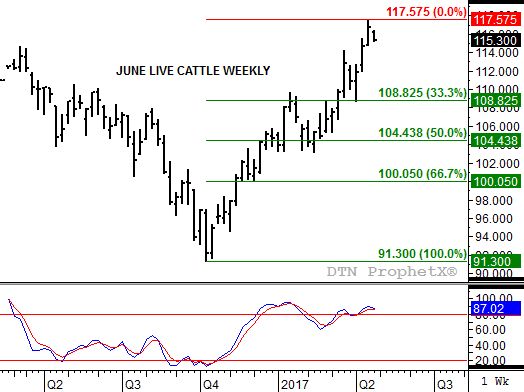

Live Cattle: The June contract closed $2.00 higher at $116.70. The contract extended its secondary (intermediate-term) uptrend, posting a new high of $117.575. Weekly stochastics are well above the overbought level of 80%, setting the stage for a potential downturn if a bearish crossover is established. If the trend does turn down in the coming weeks, initial support is at the 33% retracement level of $108.825.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feeder Cattle: The August contract closed $1.975 higher at $142.25. The contract extended its secondary (intermediate-term) uptrend, posting a new high of $145.55. Weekly stochastics are well above the overbought level of 80%, setting the stage for a potential downturn if a bearish crossover is established. If the trend does turn down in the coming weeks, initial support is between $137.15 and $131.925. These prices mark the 23.6% and 38.2% retracement levels of the previous uptrend from $199.90 through last week's high.

Lean Hogs: The June contract closed $4.175 lower at $68.325 last week. The secondary (intermediate-term) trend remains down with last support at the previous low of $66.40. Weekly stochastics are below the oversold level of 20%, setting the stage for a possible bullish crossover marking the end of the downtrend.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.22, down 12 3/4 cents for the week. The NCI.X remains in a secondary (intermediate-term) downtrend on its weekly close only chart with initial support at $3.18 1/4. However, cash corn is in Wave C (third wave) of a 3-wave move meaning it should take out the Wave A low of $3.17 1/4. This puts the downside target at $3.12, a price that marks the 50% retracement level of the previous uptrend from $2.85 1/4 through the high of $3.38 1/2.

Soybean meal: The July contract closed $8.20 lower at $313.60. Despite last week's lower close the contract remains in a secondary (intermediate-term) uptrend. Initial support is at the recent low of $309.60. The next upside target is $327.80, a price that marks the 38.2% retracement level of the previous downtrend from $357.20 through the $309.60 low.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .