Technically Speaking

Pork Bellies, Your Memory Lives On in USDX

A quick poll: How many of you are old enough to remember trading pork belly futures? Wow! That's a lot of you. Okay, you can put your withered, shaking hands down. Looked like a vote at the crypt keepers convention there for a minute. Anyway, for those of you not old enough to feel the heart tremors of holding a position in bellies look no further than Thursday's action in the U.S. dollar index (USDX) to wee what it used to be like.

Global currency markets went into the day on edge with what European Central Bank (ECB) president Mario Draghi might do and say. Mid-morning (U.S. time), the ECB announced it was taking interest rates to zero, kicking the legs out from under the euro and sparking a rally of 1.249 (1.3%) from Wednesday's close.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

However, President Draghi statement shortly after the move saying the ECB was unlikely led to an equally strong rally in the euro leading to a USDX crash. Ultimately the latter would fall more than 3.0 full points to a low of 95.390 before finally, breathlessly, closing down 1.107 (1.1%) at 96.066.

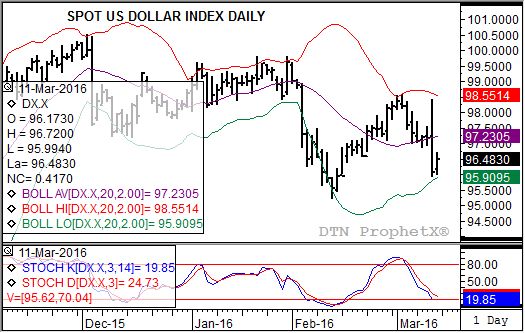

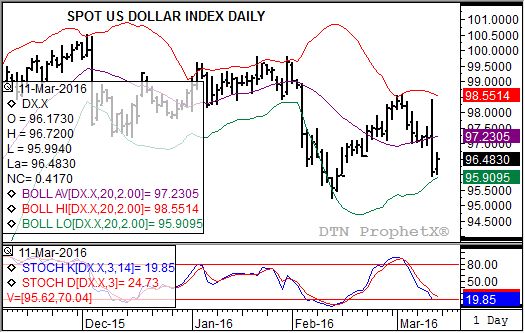

The attached USDX daily chart is a shining example of both the good and bad in trying to follow minor (short-term) trends. Certainly Thursday's move counts as a bearish outside day, meaning the minor downtrend is certainly strengthening and another round of selling should be seen. Yet early Friday found buyers returning to the bombed ruins of the day before, leading to a rally of about 0.500.

Note that daily stochastics (short-term momentum study) show the USDX is nearing an oversold situation as the index itself holds above its previous short-term low of 95.230 from February 11.

The craziness of the USDX daily chart is just the latest example as to why I lean more heavily on secondary (intermediate-term) patterns on weekly charts and major (long-term) trends on monthly charts. There the USDX remains in a downtrend in both, just past the secondary mid-point and only beginning its major move. It is interesting to note support on all three charts is at that same February low.

If the USDX remains under pressure heading into next week's Federal Open Market Committee (FOMC) meeting, there's a strong possibility it could be testing this support when the next decision on interest rates is announced. Given the secondary and major downtrends, the technical forecast would be the Fed makes no move on interest rates.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .