Technically Speaking

All Eyes on US Dollar Index Close

Historically, there has been a strong negative correlation between the direction of the US dollar index and commodities in general. As summer reaches its midpoint this week, the US dollar index is at an important crossroads where its close on Friday, July 12 could determine its secondary (intermediate-term) trend, and thus providing support or applying pressure to the commodity sector, including grains.

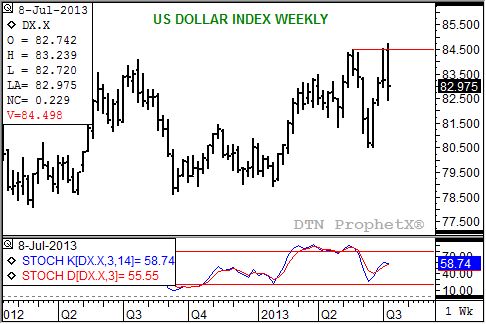

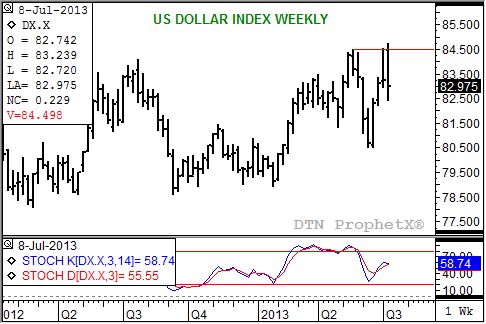

A look at the weekly chart for the spot US dollar index shows us why. This week has seen the index trade well outside last week's range of 84.530 to 82.967. In fact, this week's activity included the index posting a new high for its recent rally of 84.753. Now, as Friday's session lengthens and the weekly close draws near, all eyes will be on where the index settles.

If above last week's finish of 83.231 this week's activity would be considered a bullish outside week, meaning its recent uptrend should continue. If so, look for renewed pressure in commodities as investors start to liquidate long futures on the idea inflation remains a low-level concern. On the other hand, a close below last week's settlement would show a bearish key reversal was established, indicating the secondary trend has turned down. This would likely provide support to most commodities, sparking buying interest similar to what has been seen recently in gold and crude oil.

Weekly stochastics (bottom study) appear to be in a state of flux at this time. The last major crossover was bearish, occurring above the overbought level of 80% back in April 2013. Since then the trend has been sideways to up, while weekly stochastics have worked sideways to down. However, given that daily stochastics have turned bearish (not shown) it could be a sign that a secondary bearish crossover could soon be seen on the weekly chart. If so, it would confirm the idea that the intermediate-term trend has turned down.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\Darin Newsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .