Market Matters Blog

Happy New Year to Winter Wheat

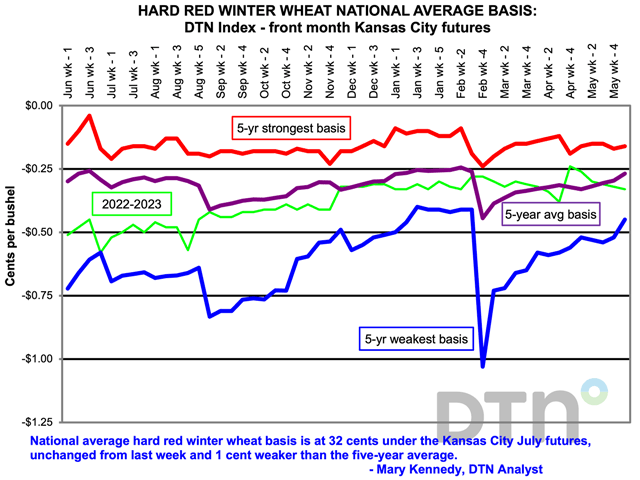

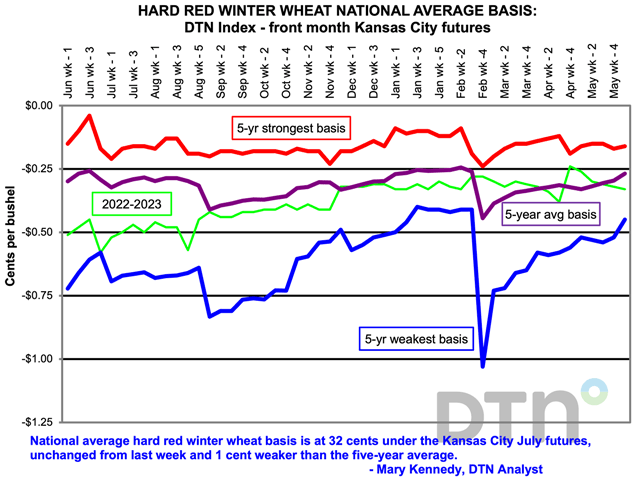

After a rough year in 2021-22, mainly because of the Russian invasion of Ukraine on Feb. 24, 2022, the DTN national average hard red winter (HRW) wheat basis started to recover late in 2022, but still ended the old crop year below the five-year average, even with lower production.

The quality of the 2022-23 crop was not an issue, with the 2022 crop grade a U.S. No. 1 HRW, thanks to the better HRW wheat growing areas that were not hit by drought. U.S. Wheat Associates (USW) reported the final weekly harvest report for the hard red winter wheat crop on Sept. 16, 2022. As of that date, the average protein came in at 12.9%, moisture was 10.7%, falling number 339 seconds, test weight 60.6 lb, damage 0.6%, shrunken and broken 1.0% and total defects were 1.8%.

In the Sept. 30, 2022, USDA Small Grains Summary, USDA said that winter wheat production was 1.10 billion bushels (bb), down 14% from the prior year. HRW wheat farmers experienced prolonged hot and dry conditions in Kansas, Oklahoma, the Texas Panhandle and Colorado. Kansas and Oklahoma were the worst of the HRW wheat growing states with lower production and hence, lower than average yields.

In the Jan. 12, 2023 USDA winter wheat seedings report, USDA said the HRW "wheat seeded area is expected to total 25.3 million acres, up 10% from 2022. Planted acreage is up from last year across most of the growing region. The largest increase in planted acreage is estimated in Texas, while North Dakota and South Dakota are estimated to be unchanged."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As spring 2023 arrived and plants started to come out of dormancy, the drought had not improved in southwest Kansas, southeast Colorado, the northern Texas Panhandle and the western Oklahoma Panhandle. There was talk on social media of abandoned acres as the crop was failing due to drought and in northern Texas, recent excess rains and flooding added more losses on top of the earlier drought.

As of the June 5 crop progress report, Kansas HRW wheat condition was rated 34% very poor, 31% poor, 23% fair, 11% good and 1% excellent. In Texas, NASS noted winter wheat condition throughout the state was rated 34% fair. In Oklahoma, the crop was rated 9% very poor, 17% poor, 37% fair, 36% good and 1% excellent. In Colorado, NASS noted that condition ratings in East Central Colorado, where the largest portion of the winter wheat crop is produced, were mostly fair to good.

As the crop year came to a close, prices drifted lower, especially in the export markets, specifically in the Pacific Northwest (PNW) export market, and also due in part to the recent reports that U.S. millers were importing Polish and German wheat starting back in April 2023.

USW recently said that, "The news that U.S. flour milling companies have imported European wheat has raised concerns and frustrations for U.S. wheat stakeholders. The concern is not about imported wheat per se. Flour millers do import varying amounts of Canadian spring wheat every year. And conditions have in the past made it possible for feed-grade wheat to be imported into coastal pork and poultry production markets. It is important to state that there is more than enough high-quality U.S. wheat available to produce all the flour we need in this country, and the 2023 harvest is already underway."

USW added, "However, imported European wheat to produce domestic flour is a highly unusual situation." USW wanted to share what is behind these imports and perhaps answer the questions from stakeholders. Dynamic market factors have created a large price spread between similar classes of European and U.S. wheat.

In May 2023, according to AgriCensus data, the published FOB export price for Polish wheat was more than $107 per metric ton less than the U.S. HRW Gulf FOB export price. German wheat export price in May showed a similar discount to Gulf HRW FOB. In looking at this difference between the bargain purchase price in Europe versus the current U.S. domestic market replacement values, USW President Vince Peterson recently said that "this may be the biggest trade margin that I've ever heard of" in all his years in the grain trade.

Looking ahead to the new year, the Economic Research Service May 2023 wheat outlook, noted that, "U.S. wheat ending stocks in 2023-24 are projected at 556 million bushels, down 7% from 2022-23 to the lowest level since 2007-08. Total supplies are down 3% from the previous year with tighter beginning stocks more than offsetting slightly higher production and imports. Production of HRW wheat is down from the previous year driven by high abandonment and low yields resulting from a second consecutive year of drought. U.S. wheat exports are down 50 million bushels year to year to 725 million bushels, the lowest level since 1971-72."

USDA ERS May 2023 Wheat Outlook: https://www.ers.usda.gov/…

Mary Kennedy can be reached at Mary.Kennedy@dtn.com

Follow her on Twitter @MaryCKenn

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .