Fundamentally Speaking

U.S. Corn Exports Over Half of USDA's Projection

Given the impressive early season sales pace of U.S. corn, it is somewhat surprising that the USDA did not increase its current export projection of 2.325 billion bushels (bb) in the November WASDE report.

Perhaps this is linked to the 2024 U.S. corn yield revised down by 0.7 bushels per acre (bpa) to 181.1 bpa, ultimately lowering the total supply estimate to 16.9 bb.

Nonetheless U.S. corn export volumes remain strong to start the 2024/25 marketing year as USDA in its latest Feed Outlook suggest U.S. corn exports will remain healthy.

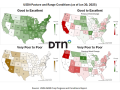

This chart shows U.S. corn sold and shipped as of the first week of November as a percent of the November USDA export projection on the left-hand axis.

Reported on the right-hand axis is the percent of corn sold to China also as the first week of November and the percent change from the USDA's November export projection until the final estimate.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Last week's export sales report showed 1.177 bb of U.S. corn had been sold since the marketing year started September 1, the fourth highest amount ever and of that 329.5 million bushels had been shipped, the largest amount for this point in the season since November 2018.

These respectively are 50.6% and 14.2% of the 2.325 bb USDA export projection and for cumulative exports basically the third highest percent ever.

So just two months into the market season we have sold over half what the USDA is projecting.

Remarkable is the fact in the other few years where total sales in the books the first week of November was 50% or more of the USDA projection, this is being done without any business from China.

In the 2011/12 season, 52.5% of projected corn exports had been sold with China taking 10.1%.

In the 2013/14 season, sales were 65.1% with China accounting for 19.6%.

Back-to-back years of 2020/21 and 2021/22 had a sales paces of 50.8% and 50.5% with China in for 31.5% and then 37.2%.

This season total sales to the PRC are a measly 25,400 metric tons which is 0.1% of total sales.

It remains to be seen if the U.S. can maintain its strong export pace without any purchases from one of the world's largest corn importers.

Casting doubt is the recent election of Donald Trump that has resulted in a firming of the U.S. dollar to two-year highs in the foreign exchange markets.

This along with threats of new tariffs have weighed on all of the grain and oilseed contracts in recent days.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .