Fundamentally Speaking

Stats Canada Wheat Estimates

Stats Can updated their production estimates for the 2023 Canadian wheat crop earlier this week. The all-wheat estimate was 31.954 million metric tons (mmt) versus the average trade guess of 31.1 mmt and compares to their September estimate of 29.835 mmt. Of this, durum accounted for 4.045 mmt and spring wheat 24.762 mmt.

Spring wheat accounts for the bulk of wheat production in Canada as opposed to the U.S., where the winter varies are more plentiful. Both the U.S. and Canada do grow large amounts of spring wheat, which is the contract traded at the Minneapolis Grain Exchange.

Canada's spring wheat crop at 24.76 mmt comes in below the year ago 25.84-mmt crop, though is well above the drought-plagued 2021 production of 16.17 mmt. Harvested spring wheat area in Canada this past season was record high at 19.15 million acres, but the yield at 47.5 bushels per acre (bpa) is well down from the year ago 53.2-bpa figure.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Similar to areas in the U.S. Northern Plains, where the bulk of the U.S. spring wheat crop is grown, the Canadian Prairies also saw very dry conditions and at times record temperatures, especially in the key spring wheat producing regions of the provinces of Saskatchewan and in particular Alberta during key parts of the growing season, which suppressed yields.

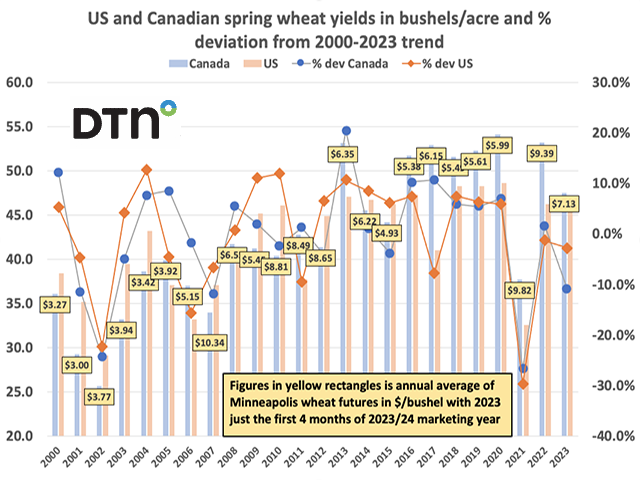

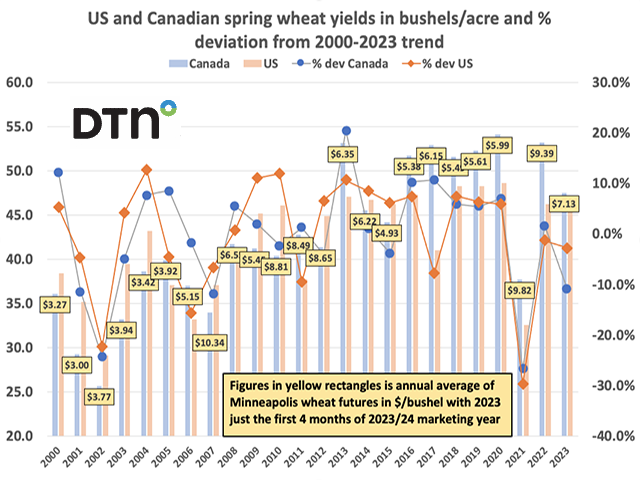

Along these lines, this chart shows U.S. and Canadian spring wheat yields in bushels per acre on the left-hand axis and those yields as a percent deviation from the 2000-2023 trend on the right-hand axis. The figures in the yellow rectangles are the annual average of Minneapolis wheat futures in $/bushel with 2023 just the first four months of 2023/24 marketing year.

It appears Canada had a tougher growing season as their 47.5-bpa yield is the second lowest since 2015 and that is off 10.9% from trend -- the second largest negative deviation from trend since 2007. The U.S. yield at 46.0 bpa is just 2.7% below trend, though the third year in a row of below-trend U.S. spring wheat yields.

Minneapolis futures last year averaged $9.39, which is the third highest annual average next to the $9.82 price the prior year, when both the U.S. and Canada saw devasting yields. The all-time high price of $10.34 was back in the 2007 season, when again both Canada and the U.S. saw poor spring wheat yields.

Interesting to note that while the correlation between U.S. and Canadian wheat yields is over 80%, each have a low correlation to Minneapolis spring wheat futures prices, suggesting Minneapolis is highly influenced by price action in both the Chicago and Kansas City winter wheat contracts.

Joel Karlin, Ocean State Research

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .