Fundamentally Speaking

Is 2013-14 USDA Corn Demand Estimate Optimistic?

The corn market right now is pre-occupied with new crop supplies and old crop demand.

It will not be too long before new crop demand is debated and already there are many who feel the 2013-14 estimated consumption estimate is rather optimistic.

Earlier this month, the USDA in response to lower estimated production pared next year’s projected corn usage by 70 million bushels to 12.850 billion bushels vs. 11.150 billion this year and that is the lowest in seven years.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

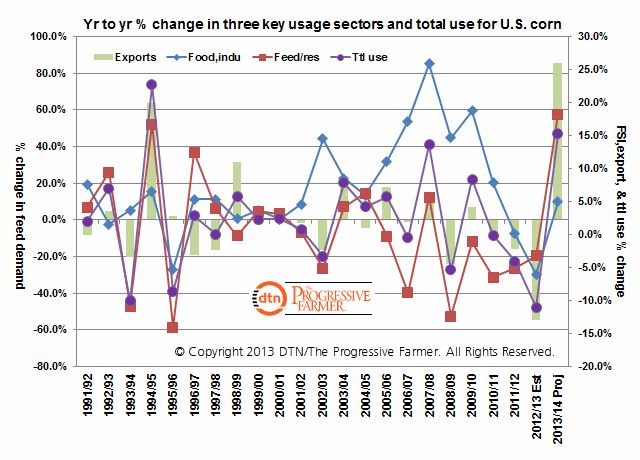

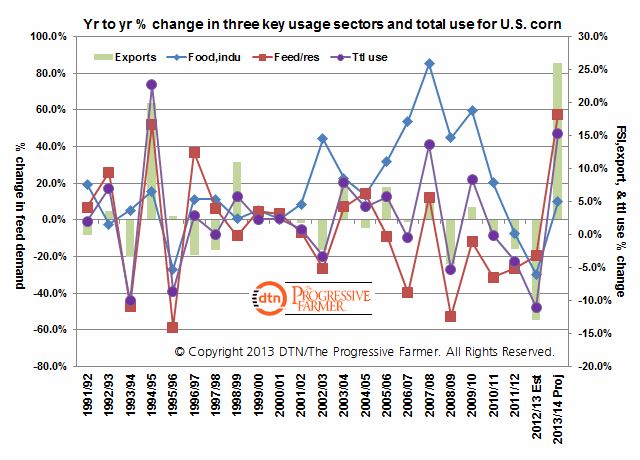

This graphic shows the year to year percent change in total corn usage and also the percent change in the three main demand components; exports, food & industrial, and feed/residual.

First off, note that the 15.2% expansion in projected total usage would be the second large increase perhaps ever, next to the 22.7% jump in the 1994-95 season.

Breaking it down by sector, feed/ residual usage is seen up 18.2% and that appears to be the largest year to year percent increase ever.

While projected prices are lower and the amount of distillers grain is not seen expanding that much next year, the large rise in projected feed demand does look a little specious to use given the lowest grain consuming animal units since 2003 and poor profitability in the corn consuming ruminant sector.

We have no quarrel with the food-industrial figure, seen up 55 million bushels or 5.0% as ethanol margins are profitable but lower total gasoline demand along with limited use of E-10 and E-85 blends implying the “blend wall” will be a big constraint.

Perhaps the biggest head-scratcher is the 85.7% projected increase in exports, by far the highest ever.

As indicated earlier, we understand that prices will be cheaper but three short U.S. crops in a row has spurred increased foreign production as the share of U.S. exports has shrunk from 60% to 20% of the world market in a mere ten years.

Traditional U.S. customers like Japan, Taiwan, and South Korea now like being able to buy Brazilian or Ukrainian corn and we imagine that they will continue to source from all exporters.

Given this situation, it will be interesting to see how U.S. corn demand fares especially if 2013 crop prospects continue to improve.

(KA)

Comments

To comment, please Log In or Join our Community .