Canada Markets

Speculative Traders Bail on Short Canola Positions

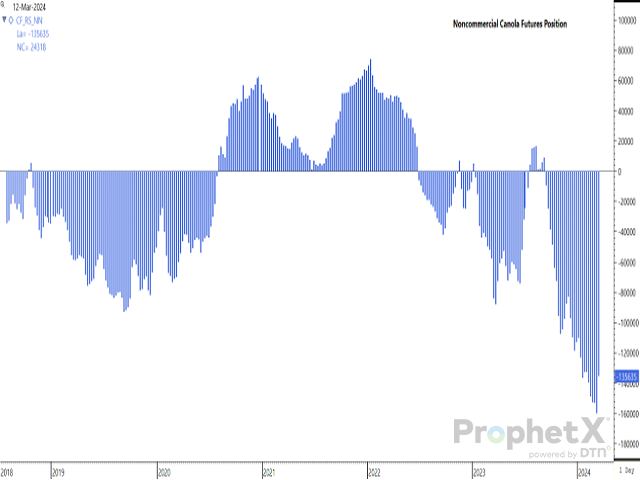

There is no question that speculative traders can remain entrenched with a bearish sentiment and trade from the short side for an extended period. From time to time, it is said these positions can be viewed as bullish in nature. A sudden change in sentiment can lead to short-covering and higher prices.

The CFTC's data release on March 15 covering activity through the week ending March 12 saw the noncommercial net-short futures position fall by 24,318 contracts from the 159,953 record net-short position reported for the previous week to 135,635 contracts. This marks the smallest net-short position held in six weeks while still the seventh-largest bearish net-short position held since weekly data was reported in August 2018.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It is interesting to note this is the largest week-over-week reduction in a net-short position for canola futures since 2018 when the CFTC began reporting canola. The next-largest weekly drop in a noncommercial net-short canola futures position was seen for the week ending June 20, 2023, which shows a 22,288 contract reduction, followed by the third-largest reduction of 20,002 contracts in the week following.

During this period in June/July 2023, the noncommercial position moved from a net short of 74,444 contracts to a net-long position of 4,109 contracts over five weeks. While history has no bearing on future events, the continuous active chart shows the canola future gaining $156.90/metric ton over this five-week period.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .