Canada Markets

Prairie Canola Basis Remains Weak

Since the Oct. 31 cash market close reported by pdqinfo.ca, canola basis has strengthened or narrowed in eight of nine prairie regions monitored as of Nov. 15 data. While basis in the Western Manitoba region strengthened by a modest $0.71/metric ton, the basis across seven regions of Saskatchewan and Alberta strengthened by a range from $4.06/mt in Northeast Saskatchewan to $5.52/mt in the Southeast Saskatchewan region. The reported basis for the Eastern Manitoba weakened $0.62/mt during this period, the only area of the Prairies to show weakness, while possibly feeling the lingering effects of the seaway strike earlier in the month.

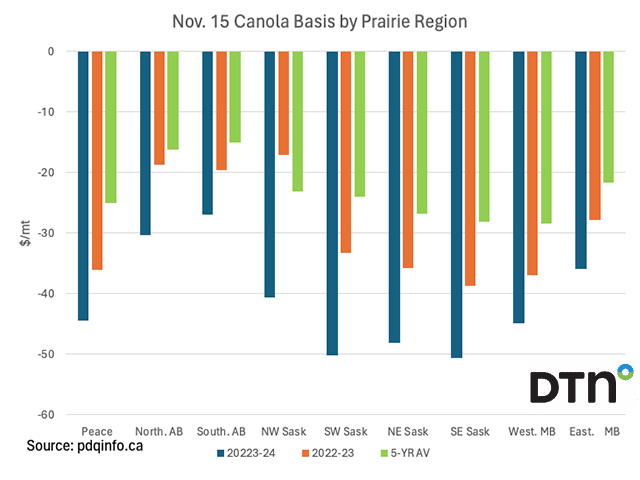

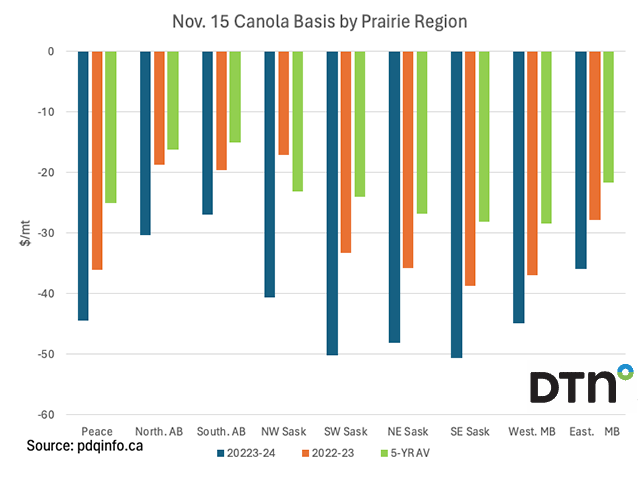

Despite the recent strength, the basis as of Nov. 15 remains weaker than the same date last year (blue bars versus the brown bars on the attached chart) and also weaker than the five-year average (blue bars versus green bars).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

When compared to past years, the basis reported for the Southern Alberta region is the closest to historical levels, largely due to the drought-reduced crop and the presence of crush plant demand. The Nov. 15 Southern Alberta basis of $26.96/mt under the January contract is $7.30/mt weaker than one year ago and $11.89/mt weaker than the five-year average.

The question remains whether producers will support buyers at current levels. In both week 13 and 14 statistics, producers delivered less than 300,000 mt of canola into licensed facilities each week, or a total of 563,800 mt during the two weeks. These were the lowest volumes delivered during nine weeks. This compares to demand or disappearance of 763,000 mt over these two weeks, leading to tighter canola stocks in commercial storage. Commercial stocks of 1.0943 mmt as of Week 14 or the week ending Nov. 5, is down 26.7% from one year ago and 30% below the five-year average for this week.

With crush margins remaining high, pressure on futures and winter just around the corner, watch for further signs of basis strength across the Prairies.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .