Canada Markets

North American Non-Durum Wheat Supplies/Export Potential

While Russia is forecast to be the world's largest wheat exporter this year, recent decisions to hold offers at a floor price of $270/mt USD has seen the country passed in the two recent Egypt wheat tenders while reports are indicating the pipeline in that country is congested. Russia is seen showing patience in moving wheat.

The most recent GASC tender was awarded to Romania and Bulgaria. There are reports today that Ukraine movement may be seen picking up, with Aljazeera.com reporting that five vessels are seen inbound for Ukraine's Black Sea ports for grain and/or grain products.

Meanwhile, Egypt -- forecast to be the world's largest buyer -- is also showing patience, having purchased modest volumes in relation to the volumes offered in each of the past two tenders.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

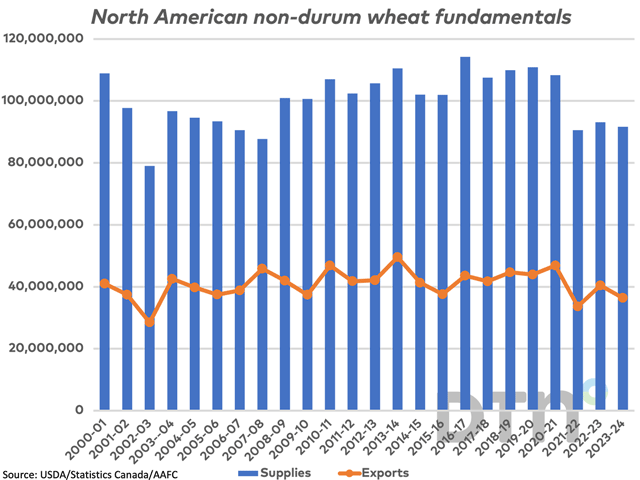

Following the release of the USDA's Small Grains Annual Survey for 2023, we look at the supplies of non-durum wheat for Canadian and U.S. wheat combined for the crop year ahead. As seen in the attached chart, this combined volume of estimated supplies falls for the third time in four years to 91.7 million metric tons (mmt), close to the lowest seen since 2007-08. This is based on ending stocks and production estimates from the USDA and Statistics Canada. As seen on the graphic, the overall trend in North American supplies has been lower since a recent 2016-17 high was reached.

Friday's USDA data shows U.S. production of wheat (excluding durum) increasing by 4.5 mmt from the previous crop year, while offsetting the 2.8 mmt drop in Canada's production, based on Statistics Canada's August model-based estimates.

According to current estimates, there may be a horse race between the U.S. and Canada when it comes to non-durum wheat exports. While Agriculture and Agri-Food Canada reduced its export forecast to 18 mmt this month, the most recent World Agricultural Supply and Demand Estimates (WASDE) report shows non-durum exports at 18.4 mmt. Note that the Sept. 30 USDA report did show all-wheat production at a higher volume than expected, which may allow an upward revision in the U.S. export potential.

The brown line on the attached chart shows the combined exports of 36.4 mmt would be the second-lowest volume shipped since 2002-03, next to the 33.6 mmt shipped in 2021-22.

As of the most recent week 8, licensed exports through Canada's licensed facilities shows exports of 3.0196 mmt, up 12.7% from the steady volume needed for the week to reach the current forecast. U.S. sales for the week-ending Sept. 21 are behind the steady pace needed to reach the current forecast.

Today's trade in the Canadian dollar against the U.S. dollar shows the loonie continuing to slump, having breached the support of $.74 CAD/USD last week, while currently trading at $0.7339 CAD/USD, its weakest trade in over three weeks. Potential support is seen at the September low for the spot dollar at $0.730470 CA/USD.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .