Canada Markets

Market Uncertainty Continues into 2023

The market closes on Dec. 30 and again on Jan. 3 clearly signal that uncertainty prevails as we enter the new year and crop prices are poised to remain in the crosswinds. Warnings seen in the media on the first day of trade in 2023 indicate a challenging year ahead.

The International Monetary Fund managing director Kristalina Georgieva has stated that 2023 will be "tougher than the year we leave behind," while focusing on a simultaneous slowing of the large economies of the United States, the European Union and China. The IMF sees China's growth rate in 2023 falling to the global average, if not below it, while for the first time in 40 years.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Watch for further rate hikes as central banks act to slow inflation without leading the economy into recession. RBC has forecast that the Bank of Canada's policy rate will remain unchanged at 4.25% throughout 2023, while the Bank of Canada itself has hinted that this rate may have to move above 5%. The challenge is that it can take six to eight quarters for higher rates to achieve the intended effect on inflation.

In addition to global recession concerns, uncertainty remains with drought conditions affecting major wheat growing areas of North America, a record soybean crop forecast for Brazil, the challenges faced in Ukraine in producing and exporting crops and crop products along with the ongoing issues faced by China with respect to the spread of COVID-19.

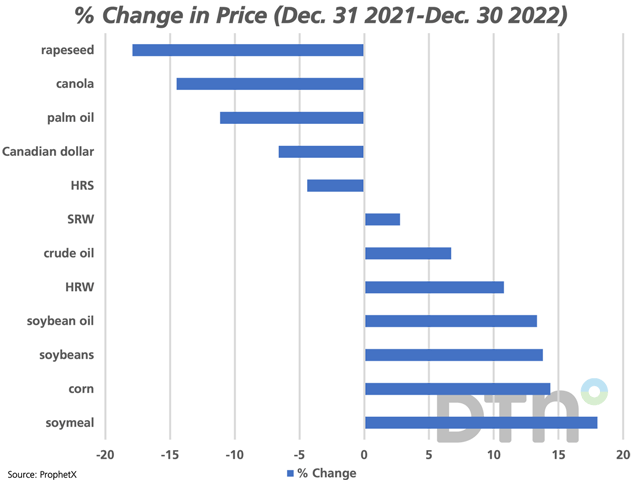

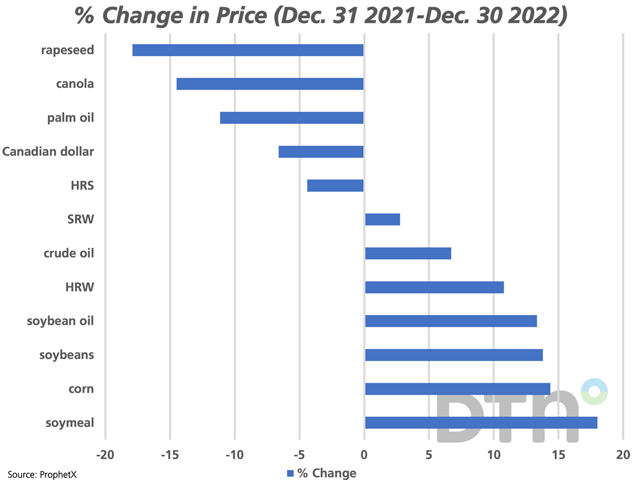

The attached chart shows the performance of various crop and crop product futures, crude oil and the Canadian dollar during the past year. Of the prices indicated, soybean, soybean oil and soymeal prices fell in the top four spots, with soymeal gaining 18% over the past year based on the movement on the continuous active chart.

The canola price fell by 14.5% over the past year, a drop that was limited by a simultaneous drop in the Canadian dollar against the USD of 6.6%. This weakness is seen as canola prices adjust to the significantly larger crop produced in 2022 while competition remains brisk from large crops produced in Australia.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .