Canada Markets

AAFC's December Supply and Demand Revisions

The December Canada: Outlook for Principal Field Crops revised supply and demand tables based on Statistics Canada's final production estimates based on November producer surveys.

Total production of all principal field crops was revised lower by 778,000 metric tons (mt) overall to 69.606 million metric tons (mmt). This revision includes a 340,000 mt lower revision in production of grains and oilseeds, while the production of pulses and special crops was revised 438,000 mt lower. Exports of all special crops was revised by a modest 69,000 mt lower, while domestic use of all major crops was revised 858,000 mt lower. Carryout stocks were revised by a modest 225,000 mt higher, to 7.650 mmt, down 5.251 mmt or 40.7% from the 2020-21 crop year.

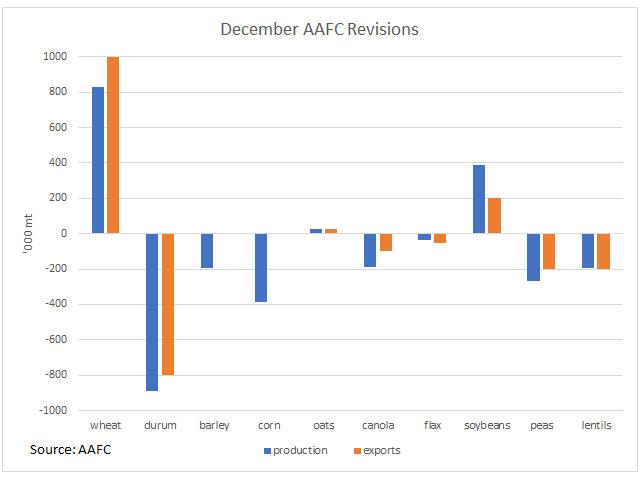

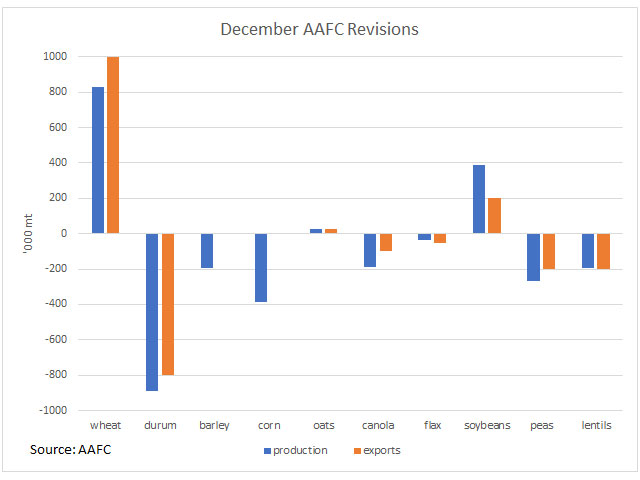

The attached chart shows the month-over-month revisions seen for the production estimate (blue bars) and the resulting revision in Canada's export potential for select crops (brown bars).

While no surprise, the data shows an increase in wheat production (excluding durum) of 828,000 mt based on Statistics Canada estimates, which consists of a 688,000 mt increase in spring wheat and a 140,000 mt increase in winter wheat production. This month's AAFC forecasts also include a 100,000 mt increase in forecast imports to 300,000 mt, while feed use of wheat was revised by 72,000 mt lower. This combination of forecasts allowed for an upward revision of 1 mmt to the export forecast of 14 mmt, with ending stocks left unchanged at 3 mmt, the lowest seen since 2007-08.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As of week 19, licensed exports totaled 4.519 mmt of wheat through licensed facilities (excluding durum), which is roughly 596,000 mt behind the steady pace needed to reach the revised forecast, although this does not include the export of flour and unlicensed exports.

The other major revision was seen for durum, where production was revised sharply lower (891,000 mt) in Statistics Canada's Dec. 3 release. As a result, exports were revised lower by 800,000 mt to 2.3 mmt, with a small downward revision seen in domestic use needed to keep ending stocks unchanged this month at 450,000 mt. As of week 19, cumulative exports of 1.123 mmt have reached 49% of this forecast and are close to 283,000 mt ahead of the steady pace needed to reach this forecast. Exports will need to slow drastically to reach this forecast; Algeria is currently in the market for durum, and it will be interesting to see who can supply this.

It should be noted that AAFC's revisions from November to December resulted in a 200,000 mt increase in all-wheat exports to 16.3 mmt, which is 1.3 mmt higher than the 15 mmt released by the USDA this month.

As seen for many crops, production for both barley and corn were revised lower, as seen with the blue bars on the attached chart, while forecast exports were left unchanged this month along with forecast ending stocks. This was made possible by a downward revision in domestic use for both barley and corn.

An interesting revision was seen for soybeans. Statistics Canada's November estimate resulted in a 386,000 mt increase in soybean production to 6.272 mmt, which is down only 1.4% from 2020, although the upward revision in exports was only 200,000 mt, with ending stocks also increased by 200,000 mt. As is also feared in the U.S., the window of opportunity is slowly closing with new-crop product in Brazil just around the corner. As of week 19, exports from licensed facilities are shown at 1.941 mmt, down 23.3% from the same period last crop year.

Production for canola was revised 187,000 mt lower this month, while exports were revised by a modest 100,000 mt lower to 5.4 mmt. As of week 19, cumulative exports of 2.613 mmt are 640,000 mt ahead of the steady pace needed to reach the revised forecast, suggesting that the pace of exports will be forced to taper soon if current estimates are correct.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2021 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .