An Urban's Rural View

This Fed Interest Rate Pause Doesn't Refresh

Judging from the Federal Reserve's recent "pause" in raising interest rates and the big reductions in inflation during the past year, farmers and ranchers couldn't be faulted for hoping the interest rates they pay will soon be falling.

Unfortunately, that's far from a sure thing despite the promising signs. Indeed, there's a good chance interest rates will continue into next year at today's uncomfortable levels or higher.

After raising rates at 10 consecutive meetings -- five percentage points in just over a year -- Fed officials voted at their June meeting to hold the benchmark Federal Funds rate steady in the 5% to 5.25% range. But Fed chair Jerome Powell hinted at the post-meeting press conference that the central bank will probably raise rates in July. Moreover, 12 of 18 Fed officials forecast at least two more rate increases this year. (https://www.federalreserve.gov/…)

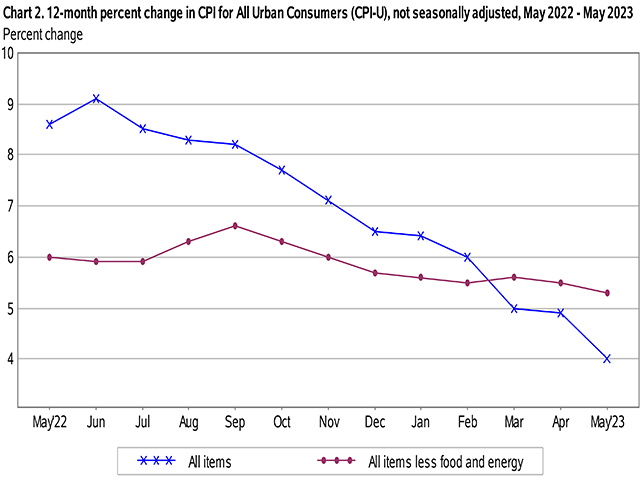

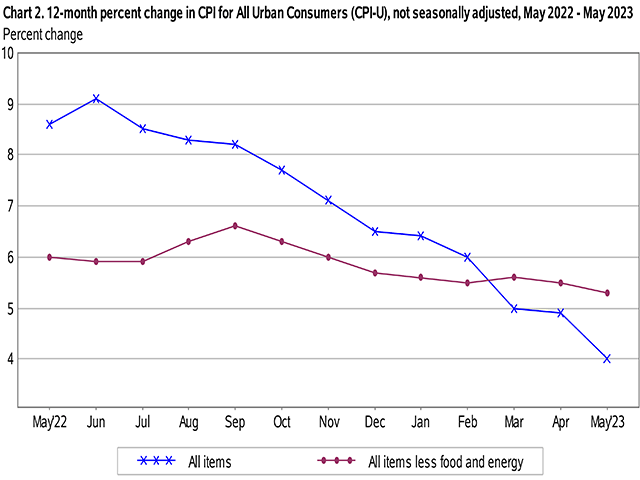

Consumer price inflation continued to fall in May, to 4% year-over-year, a big improvement over the 9% increase in June of last year. But 4% is still well above the Federal Reserve's 2% target, and "core" inflation, which excludes volatile food and energy prices, was 5.3% higher.

Fed officials fear the easy wins in the war against inflation have been won; they worry the remaining battles will be tougher. Even as they paused raising rates, they revised upward their forecast of where inflation will clock in at year end.

Among the reasons for their pessimism: Core inflation isn't coming down as fast as overall inflation, suggesting that while food and energy prices are easing significantly, price increases for other items aren't. Fed officials increased their forecast of core personal consumption expenditures, the inflation measure the Fed focuses on, to 3.9% at the end of 2023, up from their March forecast of 3.6%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Then, too, the economy's continued strength supports fears that inflation will remain sticky. Interest rate increases lower inflation by slowing the economy and reducing demand for goods and services. In June Fed officials raised their economic growth forecast for the year to 1% from 0.4%, (https://www.federalreserve.gov/…) suggesting interest-rate hikes aren't braking the economy as much as hoped, at least not yet.

Inflation hawks point out that despite the 5-percentage-point increase in nominal interest rates, "real" or inflation-adjusted rates are still low. To the hawks, that means monetary policy isn't very restrictive.

Depending on which inflation measure you use, real interest rates may be only around 1%. The hawks argue it will take much higher real rates to wring inflation out of the economy. By pausing, the hawks argue, the Fed is ensuring that rates will have to remain elevated for a longer period of time.

There is a more optimistic way to view the inflation outlook. It holds that distortions from the pandemic linger in the government data, especially in the prices of shelter and cars. These distortions will, the optimists believe, soon disappear, bringing the government's measures of inflation down.

Economist Paul Krugman, for example, says he increasingly watches something called "super-core" inflation, which excludes not only food and energy but shelter and cars. By this measure, inflation has declined to just above 3%.

While super-core inflation probably excludes too much to be a dependable yardstick, many investors seem convinced that inflation will come down to 2% faster than the Fed thinks. That, indeed, seems to be one of the reasons the stock market is on a bull run.

The Fed hasn't signed on to the inflation hawks' case; only one Fed official sees the Fed funds rate going above 6% in the next few years. But Fed officials aren't buying into the optimism, either. None of the 18 officials see a Fed funds rate below 5% this year and four don't see it below 5% until 2025. (The median forecast is for a 5.6% interest rate at the end of this year and a 4.6% rate at the end of 2024.)

Sharp declines in inflation in the months ahead could change officials' minds about when to start cutting. But those declines aren't likely to happen unless the economy slows and the labor market cools down.

Interest rates averaged 7% on farm real estate loans and 7.5% on farm operating loans in the first quarter, according to a Kansas City Fed report. (https://www.dtnpf.com/…) It would be very good news for agriculture if Krugman and the stock market prove right and the Fed starts lowering rates.

But given the uncertainties, it wouldn't be wise to count on that. Fed chair Powell warns that "the process of getting inflation down to 2% has a long way to go."

Alas, Coca-Cola's old slogan, "The Pause That Refreshes," doesn't seem to apply to this Fed pause.

Urban Lehner can be reached at urbanize@gmail.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .