Technically Speaking

Weekly Analysis: Livestock Markets

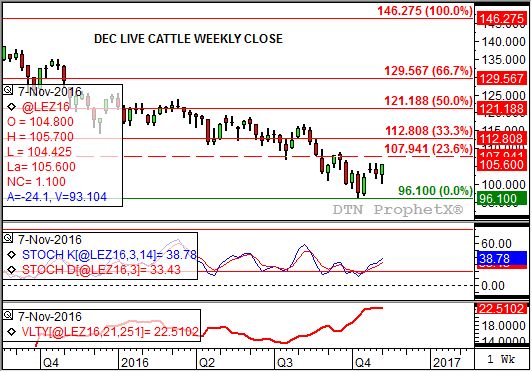

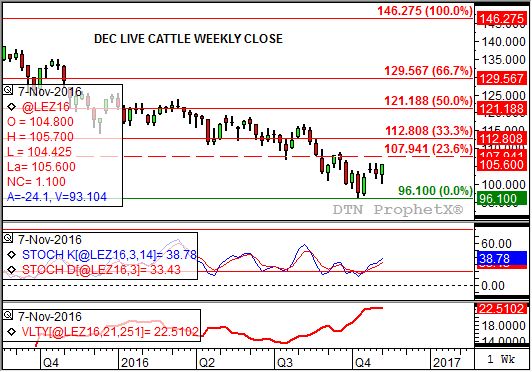

Live Cattle: The December contract closed $2.875 higher at $105.60. As usual the live cattle market is a complicated mix of trends. The major (long-term) trend still looks to be up while the minor (short-term) downtrend has been put on hold while Dec cattle move toward a test of the previous high of $106.00. That leaves the secondary (intermediate-term) trend stuck in the middle, but still looking to be in an uptrend. Initial resistance is at the 4-week high of $106, then $107.95. The latter marks the 23.6% retracement level of the previous downtrend from $146.275 through the low of $96.10.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feeder Cattle: The January contract closed $3.175 higher at $121.025. The secondary (intermediate-term) trend remains up. Jan feeders have moved above initial resistance near $120.00. a price that marks the 23.6% retracement level of the previous downtrend from $150.15 through the low of $110.65. Weekly stochastics are bullish meaning buying enthusiasm should continue to strengthen.

Lean hogs: The December contract closed $0.975 higher at $47.125 last week. While the secondary (intermediate-term) trend remains up, it may have posted a Wave 1 peak just below initial resistance near $49.55. This price marks thee 33% retracement level of the previous downtrend from $67.325 through the low of $40.70. The minor (short-term) trend is now down, representing Wave 2 of the intermediate 5-Wave trend. Being a Wave 2, Dec hogs could see almost a full retracement of Wave 1.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $2.99 1/4, down 7 cents for the week. While the secondary (intermediate-term) trend remains up the minor (short-term) trend is down. The NCI.X is testing minor support at $2.98 3/4, a price that marks the 38.2% retracement level of the previous uptrend from $2.73 through the high of $3.14 3/4. Given continued bearish daily stochastics, the NCI.X could test the 50% retracement level of $2.93 3/4.

Soybean meal: The December contract closed $1.20 lower at $307.80. While the secondary (intermediate-term) trend remains up, the market's minor (short-term) trend is down. Minor support is pegged at $305.70, a price that marks the 67% retracement level of the previous minor uptrend from $294.10 through the high of $328.80. The 76.4% retracement level is down at $302.30.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .