Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $0.83 lower at $44.75. The market's secondary (intermediate-term) trend remains down as the spot-month contract moved below support at $44.85. This price marks the 33% retracement level of the previous uptrend from $27.10 through the high of $53.73 (week of October 10). The 50% retracement level is down at $40.41. Weekly stochastics remain bearish, as does the nearly $1.00-plus contango of the nearby futures spread.

Crude Oil: The spot-month contract closed $0.66 lower at $43.41. The secondary (intermediate-term) trend remains down as the spot-month contract continues to move toward support at $42.04. This price marks the 38.2% retracement level of the previous uptrend from $26.05 through the high of $51.93, a double-top with the peak of $51.67 (week of June 6). The 50% retracement level is down at $38.99, near major support pegged at $38.86 and the August low of $39.19.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 2.31cts lower at $1.4012. The secondary (intermediate-term) trend is down. Next support is pegged at $1.3674, a price that marks the 33% retracement level of the previous uptrend from $0.8487 through the recent high of $1.6264. The 50% retracement level is down at $1.2376.

Gasoline: The spot-month contract closed 7.33cts lower at $1.3053. The secondary (intermediate-term) trend is down with the spot-month contract testing support at $1.2820. This price marks the 50% retracement level of the previous uptrend from $0.8975 through the high of $1.6664. Weekly stochastics remain bearish, meaning a test of the 67% retracement level at $1.1535 is possible.

Ethanol: The spot-month contract closed 2.8cts lower at $1.520. Bearish weekly stochastics indicate the market has rejoined it secondary (intermediate-term) downtrend. The spot-month contract is testing support at $1.518, a price that marks the 50% retracement level of the previous uptrend from $1.296 through the high of $1.739. The 67% retracement level is down at $1.444.

Natural Gas: The spot-month contract closed 14.8cts lower at $2.619. The secondary (intermediate-term) trend remains down with next support pegged at $2.489. This price marks the 50% retracement level of the previous uptrend from $1.611 through the high of $3.366. Weekly stochastics are bearish meaning the spot-month contract could test the 67% retracement level of $2.195.

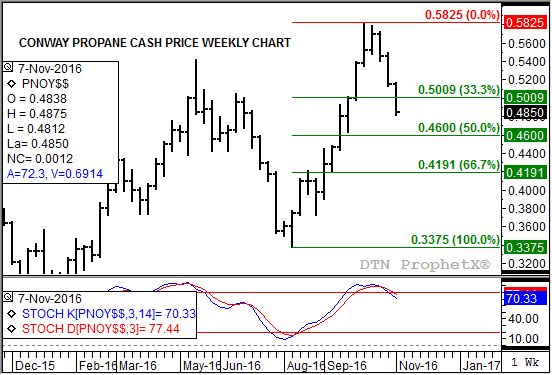

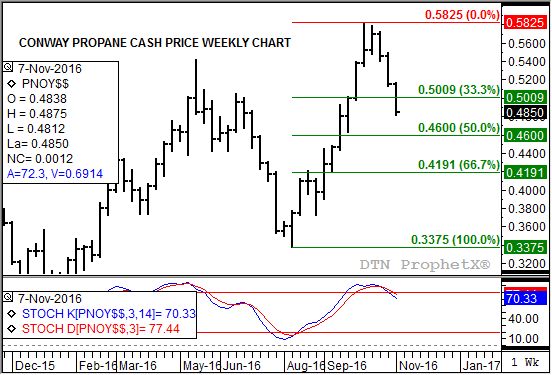

Propane (Conway cash price): Conway propane closed 3.00cts lower at $0.4850. The secondary (intermediate-term) trend remains down. Next support is at $0.4600, a price that marks the 50% retracement level of the previous uptrend from $0.3375 through the high of $0.5825.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .