Fundamentally Speaking

South American Soybean Production Impact

As expected, the December WASDE report was a non-event with USDA keeping U.S. corn and soybean ending stocks unchanged while also leaving unrevised its estimates for Argentine and Brazilian corn and soybean production for this year.

With regard to the latter, combined soybean output for Brazil and Argentina for the 2019/20 season is pegged at 176.0 million metric tons (mmt) and that appears to be a record topping the prior peak set a year ago at 172.30 mmt.

The soybean crops in both countries are currently being planted so production prospects in each along with the state of U.S.-China trade relations will be the main drivers for soybean prices over the next few months.

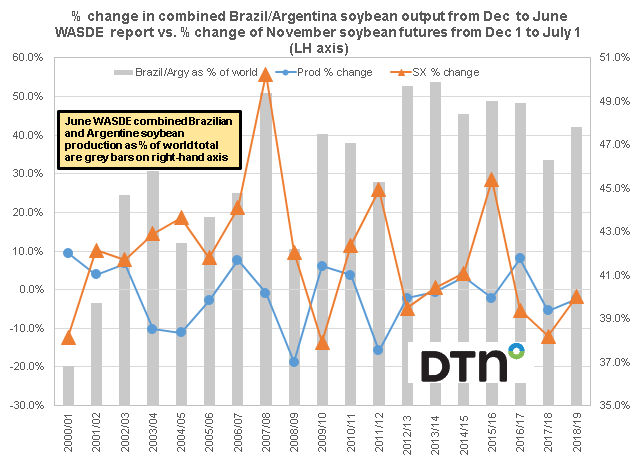

This graphic shows the percent change in combined Brazilian-Argentine soybean production from the December to June WASDE report and the percent change in November soybean futures from December 1 to July 1 for that marketing year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Both of these are plotted on the left hand axis while on the right hand axis is the combined Brazilian-Argentine soybean production total as a percent of world soybean output taken from the June WASDE figures.

As to be expected, a deterioration in South American soybean production prospects usually results in November soybean prices appreciating from November through June though that is not the only factor influencing values.

The largest production decline over the past 20 years on a percentage basis came in the 2008/09 season where the USDA lowered output from 109.5 mmt in the December 2008 WASDE report to 89 mmt in the June 2009 WASDE, an 18.7% decline.

This came at a time when the November 2009 soybean contract moved from $8.96 on 12/1/2008 to $9.83 per bushel by 7/1/2009, a 9.7% advance.

Of course, there have been years where falling South American output has not triggered a price rise and cases where an increase in soybean production has not resulted in price declines.

Soybean prices are also influenced by domestic factors including the final U.S. crop production report of the year in January, the end of March planting intentions figure and spring weather that will have a bearing on both corn and soybean seedings.

We do note that combined Argentine-Brazilian soybean production over the past 20 years has moved from about 40% of the world total to 50%.

In the process, the correlation between the production change and the price change has increased from 29.3% to 45.9%, implying that soybean production in both countries has a far greater impact on soybean futures prices than was the case in the past.

(KR)

© Copyright 2019 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .