Fundamentally Speaking

Change in S. American Soybean Output vs. change in Nov Futures

The USDA will release a slew of reports this Friday and one of the more awaited figures will be the updated soybean production estimates out of South America.

Since the December 2018 WASDE report was issued, heat and dryness has impacted a large part of northern Brazil, especially in the Parana and Mato Grosso du Sol regions.

Consequently, the average trade guess for the 2018/19 Brazilian soybean crop has fallen to 116.5 million metric tons (mmt) vs. the 122.5 mmt USDA projection back then.

Note that some estimates are as low as 112.0 million tonnes with stress seen in other producing states.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Argentina has had the opposite problem with excess precipitation in some areas, but the impact is thought to be less severe with the average trade guess at 55.2 mmt vs. USDA's December 2019 projection of 55.5 mmt.

This still represents a combined 5.8 mmt decline from what was anticipated two months ago.

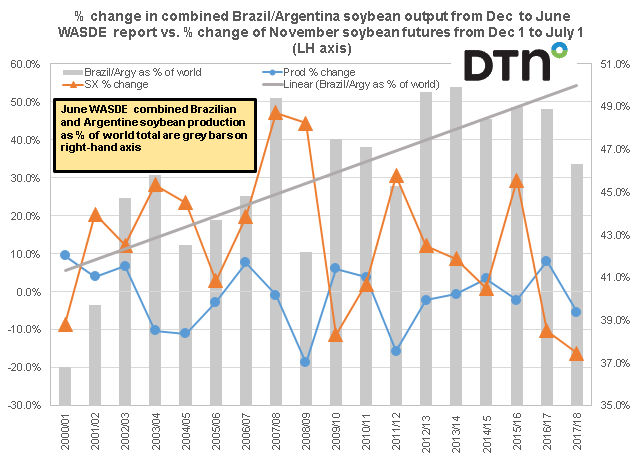

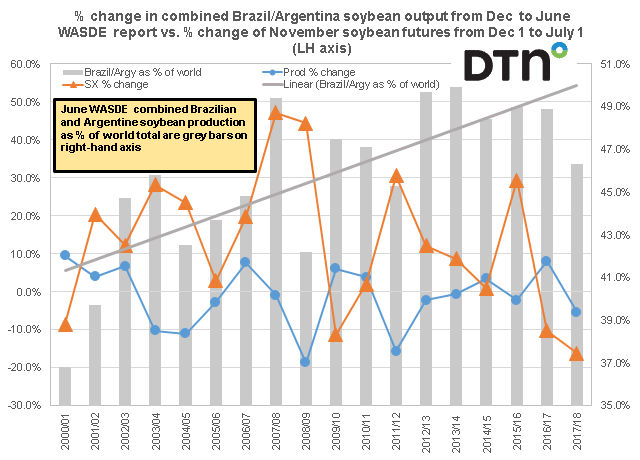

Along these lines, this graphic shows the percent change in combined Brazil/Argentina soybean production from the December to the June WASDE report vs. the percent change in price of November soybean futures from December 1 to the following July 1 and these are plotted on the left hand axis.

On the right-hand axis are the grey bars which is the percent that combined Argentine and Brazilian soybean production accounts for the global output total.

That trend shows how these two countries are increasingly accounting for a larger share of world soybean production and this would imply a greater impact on the direction of futures prices.

As one would expect, a drop in combined soybean production should have a positive impact on futures prices and vice-versa, especially if the percent decline or increase is relatively large.

The largest percent drop was in the 2008/09 season of 18.7%, resulting in a 44.4% increase in November 2009 soybean futures from 12/1/08 to 7/1/09,and a 15.7% drop in the 2011/12 season resulting in November futures advancing by 30.5% in those seven months.

More recently, an 8.1% increase in combined soybean production estimates resulted in a 10.3% drop in November 2017 soybean futures.

Note that the correlation between the two is a decent negative 58.2% suggesting other factors are at play including U.S. production prospects and more recently the ongoing trade war with China.

(KLM)

© Copyright 2019 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .