Fundamentally Speaking

Grain Price Levels and Volatility

We have seen a number of press reports noting that the lowest values of grain and oilseeds in at least ten years, along with depressed levels of price volatility, is making trading rather difficult for the world's largest agricultural companies that make money selling and buying commodities like corn, soybeans and wheat.

As we have noted a number of times in the past, strong crop production worldwide over the past few years, a U.S. dollar close to 14 year highs in the foreign exchange markets and a plateauing of demand for crops used in the renewable fuels industry, are among some of the reasons for the depressed prices for a number of agricultural goods.

Not to get too technical here but a common measure of volatility used by traders and analysts is the standard deviation.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This metric reflects the average amount a commodity's price has differed from the mean over a period of time.

It is calculated by determining the mean price for the established period and then subtracting this figure from each price point.

The differences are then squared, summed and averaged to produce the variance.

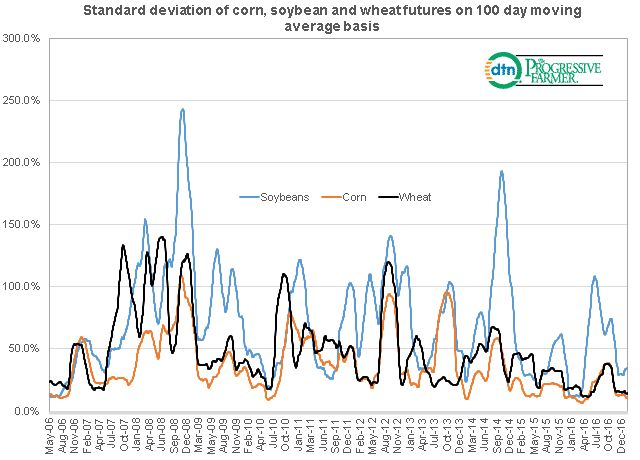

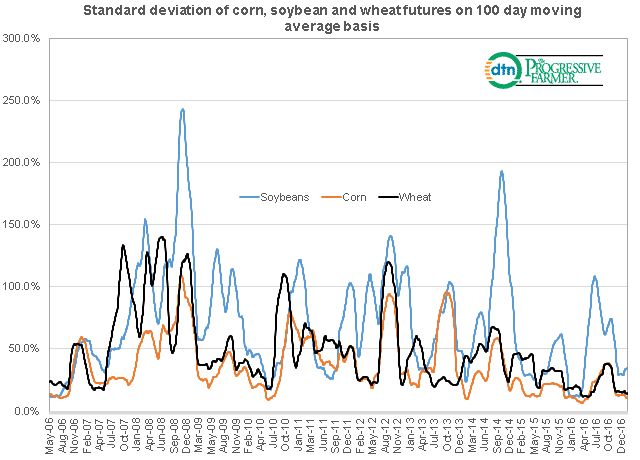

In this piece we look at the 100 day moving average of the standard deviation of corn, soybeans and wheat with zero meaning no volatility with higher values associated with increased volatility.

The current 100 day moving average for the standard deviation currently are all at depressed levels with soybeans at 34.6% vs its long-term average of 71.5%, corn's standard deviation now at 10.4% vs. its 26.9% average and wheat at 14.4% vs. its long-term average of 30.6%.

We note that the standard deviation for soybeans is now it's the lower 20% of the its range since mid-2006, corn in the lower 5% and wheat in the lower 3% so the volatility of corn and wheat are very depressed.

This suggests that option prices may be rather low as volatility is one of the factors that account for an options premium value since this may be a propitious time to be an option buyer, especially call options of one has a bullish bent.

(KA)

Comments

To comment, please Log In or Join our Community .