Canada Markets

Global Wheat Markets Search for Bottom

While Russian milling wheat is not in direct competition with all classes of North American wheat, it continues to fall in price and contributes to the tone of the global market.

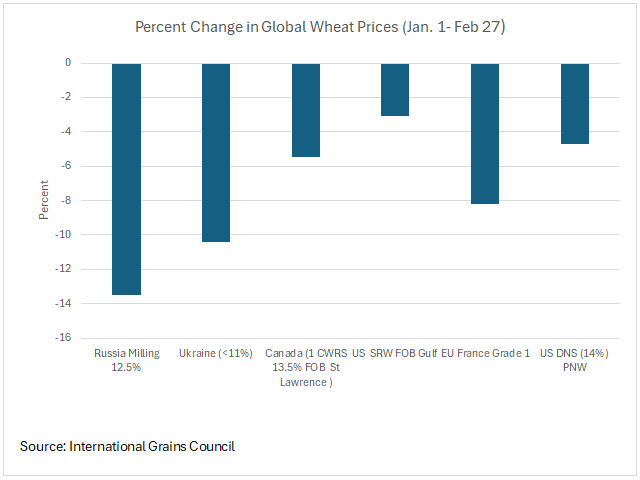

The International Grains Council reports Russia's milling wheat 12.5% falling by $2 per metric ton (mt) USD over the past week to $212/mt, a seventh consecutive week of falling prices. Since Jan. 2, the IGC reports Russia's price has fallen by $33/mt or 13.5%, a far greater percentage drop than the other select international prices shown.

As shown on the attached chart, this compares to smaller percent drops for select qualities and origination points for North American wheat with United States soft red winter wheat FOB Gulf ports down 3%, U.S. Dark Northern Spring Wheat 14% FOB the Pacific Northwest down 4.7% and Canada Western Hard Red Spring 13.5% FOB the St. Lawrence down 5.4% over this period.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The Feb. 28 IGC Grain Market Indicators report indicates wheat deliveries to Russia's export locations are up 15% year over year, leading exporters to lower their offers to facilitate movement. The report indicates that Ukraine is also undercutting competing offers in Asian markets to generate sales.

Of the six crops shown on the chart, Canadian offers for CWRS are the second-highest price at $295/mt FOB the St. Lawrence. U.S. DNS FOB the PNW is slightly higher at $303/mt. These two offers are also the two highest seen across the 13 wheat prices tracked by the ICG, which are expanded to include Argentina, Australia and Germany along with other offers of U.S. wheat.

A couple of things to watch in western Canada include a sharp uptick in the number of vessels on the Vancouver vessel list along with a sharp drop in the Canadian dollar against the USD. Despite the current pace of Canada's wheat exports (excluding durum) being well ahead of the government's forecast pace, this week's Grain Marketing Program Weekly Performance Update for week 29 shows the West Coast vessel lineup for week 30 jumping to 38 from 29 in the previous week, well ahead of the one-year average of 22/week. This sharp move higher will undoubtedly point to more robust wheat loading to come.

As well, the spot Canadian dollar reached a fresh 2024 low of $.7350 CAD/USD in Feb. 28 trade, the lowest reached since the week of Dec. 11, 2023. This will help to make Canadian wheat increasingly competitive in U.S. dollar terms.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .