Canada Markets

Sell Signals Seen for Yellow Peas

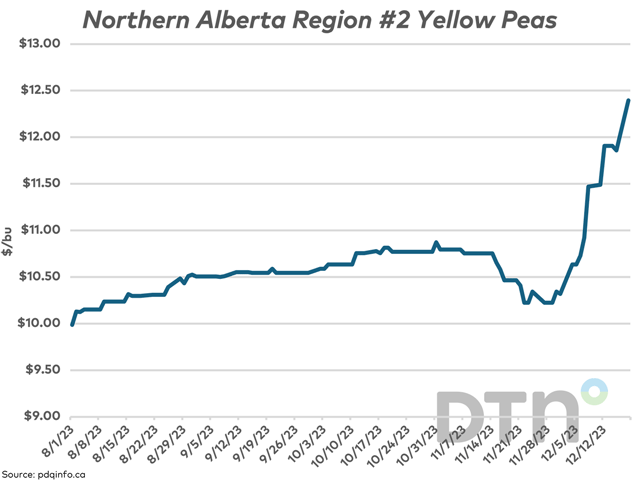

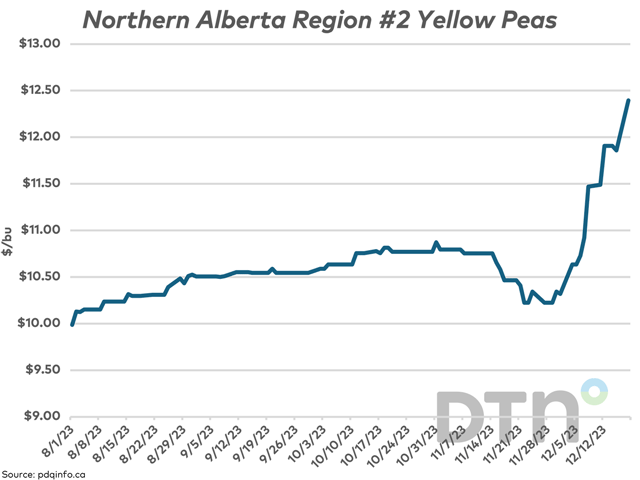

The site https://pdqinfo.ca/… price data for Dec. 18 shows yellow pea bids increasing from as much as $9.66/metric ton ($0.26/bushel) in the western Manitoba region to a high of $19.67/mt ($0.54/bu) in the northern Alberta region, as shown on the attached chart.

Bids range from $406.13 or $11.05/bu in eastern Manitoba to $455.43/mt or $12.39/bu in northern Alberta. It is very likely that even higher prices are being paid, with https://statpub.com/… reporting Saskatchewan elevator cash bids ranging from $10/bu to $13/bu, averaging $11.74/bu.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The current inverse in this market bears watching. India has suspended their 50% import duty until March 31, which means a scramble is underway to take delivery of product and move it into an export position. Some have indicated that this opportunity will end at the end of this month.

It is interesting to note that spot bids offered are shown at a small premium to the January bid, while this inverse increases when compared to the February bid, which ranges from $47.41/mt to $70.99/mt ($1.29/bu to $1.93/bu) lower across the nine regions. The need or the desire to own product is clearly favoring front-end or spot deliveries.

It is interesting to note that this month's Agriculture and Agri-Food Canada (AAFC) supply and demand estimates included a 337,000-metric-ton increase in prairie production due to an upward revision in yield, with production estimated at 2.609 based on Statistics Canada's November estimates, down 23.8% from the previous crop year. Despite the early December move by India to reduce import duties on yellow peas and the sudden interest across the trade, AAFC left its export forecast unchanged this month at 1.9 million metric tons, while revising ending stocks higher by 295,000 mt to 570,000 mt, or from 11% stocks/use ration to 22% stocks/use, up from 15% estimated for the previous crop year. AAFC also left its estimated producer return for the year unchanged from the previous month at $420/mt, or $11.43/bu.

Note that Dec. 19 bids reported by pdqinfo.ca show a drop of $3.13/mt to $6.67/mt across the nine regions ($0.085 to $0.18/bu).

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .