Canada Markets

AAFC Forecasts Canadian Grain Stocks to Grow Larger

Agriculture and Agri-Food Canada's September supply and demand tables point to increasing supplies and demand for Canadian crops, while stocks are also to increase overall. The September analysis includes the most recent official production estimates from Statistics Canada, although the 2022 harvest is far from finished and there is a great deal uncertainty and crop year ahead.

The forecast shows total supply of all principal field crops at 110.287 million metric tons (mmt), up 19.4% or 17.9 mmt from the previous crop year while still below the 117.593 mmt reported for 2020-21.

Total exports of grain are forecast to rise by 15.357 mmt or 42.7% to 51.290 mmt, while total domestic use of all crops is to fall by 772,000 metric tons (mt) year-over-year to 46.427 mmt. Ending stocks are forecast to increase by 3.342 mmt or 36.2% to 12.570 mmt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

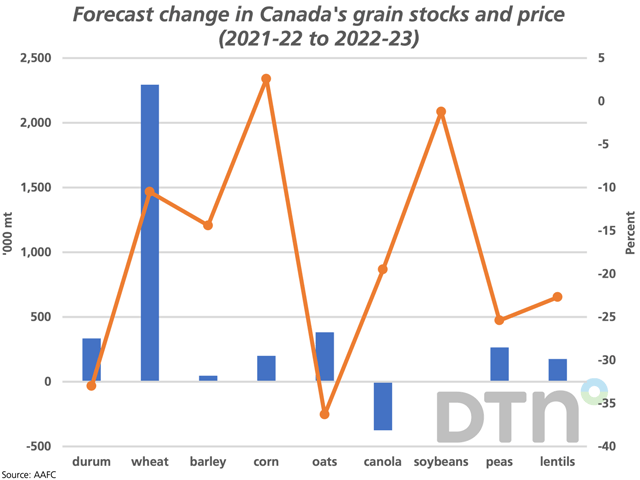

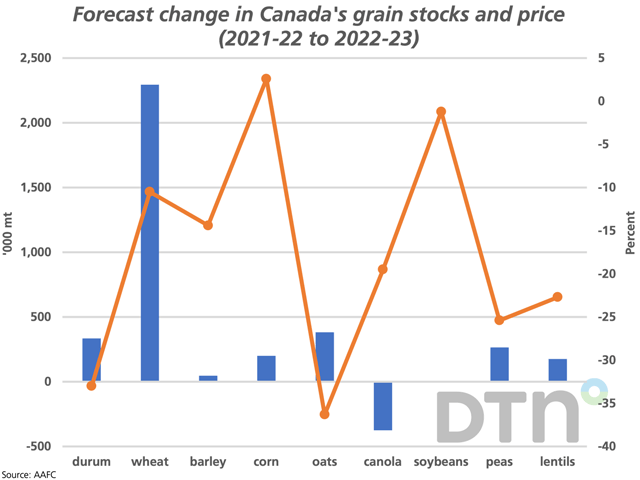

As seen by the blue bars of the attached chart, stocks for the crops shown are forecast to increase year-over-year for all crops except for canola, which is forecast to see stocks fall by 375,000 mt to 500,000 mt. Of the smaller principal field crops not shown, the ending stocks forecast for dry beans, chickpeas and sunflower seed show a year-over-year decline, while stocks of soybeans are forecast to remain unchanged from one crop year to the next at 400,000 mt.

Of the total 3.342 mmt increase in forecast stocks, the year-over-year change in wheat stocks of 2.294 mmt and an additional 335,000 increase in forecast durum stocks account for 78.7% of the total increase.

When this forecast is compared to the five-year average for the largest crops, we see that wheat stocks (excluding durum) at 5.4 mmt would be 905,200 mt higher than the five-year average while canola stocks at 500,000 mt would be 2.131 mmt lower than the five-year average. Forecast ending stocks for 2022-23 durum would be below average, along with barley, soybeans and lentils. At the same time, stocks of corn and peas would be above average.

When the forecast prices are considered (brown line with markers), we see that prices for row crops are showing resilience, with the estimated corn return up 2.6% while the soybean price is forecast to fall by only 1.2%, year-over-year. The remaining crops shown on the chart range from a 10.5% year-over-year drop in wheat price to a 36.3% drop in the forecast oat price.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .