Sort & Cull

Live Cattle Prices End Higher on the Week; Fed Keeps Interest Rates Unchanged

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

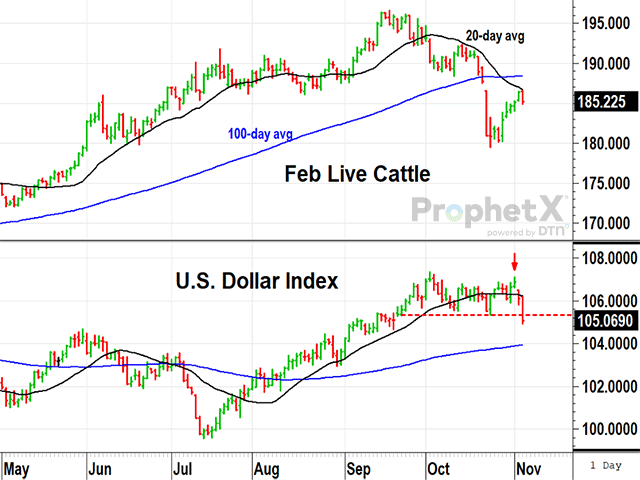

February live cattle closed up $2.27 in the week ending Nov. 3, 2023, still recouping from the shock of higher-than-expected bearish placements and the flush of noncommercial selling that followed on Oct. 23. Despite the week's higher close, the Nov. 3 report from CFTC showed specs lightened positions further, dropping 6,671 net longs to 50,186 as of Oct. 31. Technically speaking, Friday's prices encountered selling after a challenge of the 20-day average at $186.70 and further short-term resistance is likely near $188, near the 100-day average and the Oct. 20 pre-report close of $187.72.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As mentioned in this blog last week (https://www.dtnpf.com/…), the fundamentals are still bullish for cattle prices as far cattle numbers are concerned. Herd size is historically low and beef cow slaughter was a little higher in the October on-feed report. If cattle prices are vulnerable to another sell-off, it would likely come from the demand side of the market, but so far, demand signs remain upbeat.

Estimated slaughter for the week ending Nov. 3 was 632,000, comfortably above 600,000 and above the one-year average. Boxed beef prices were down on the week, down $5.23 for choice beef and down $8.11 for selects, but so far, choice prices remain stable above $300 at a time when interest rates are high and the world is dealing with two active wars.

The recent attack on Israel and the stress it puts on the West was likely behind the Federal Reserve's decision to keep the federal funds target unchanged on Nov. 1. The upper limit of 5.50% is the highest in 22 years but has not yet been successful in bringing down inflation to the Fed's 2% target. Friday's report from the Labor Department did show the U.S. economy lost 348,000 jobs in October, going from the record high of 161.57 million in September to 161.22 million.

Friday's lower close in February cattle may have been negatively influenced by the drop in jobs, but the report also had a bullish facet as the U.S. Dollar Index fell over a full point the same day to a new one-month low of 105.07. The bearish break in the dollar left behind a lower high and makes a better case for traders to consider the long side of ag commodity prices, like cattle. On Nov. 6, DTN reported northern dressed cattle trades for the week were roughly $2 higher, near $292, while southern live deals were down 50 cents, near $185.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .