Sort & Cull

Packers Bought Aggressively in Last Week's Cash Market to Build Up Inventory

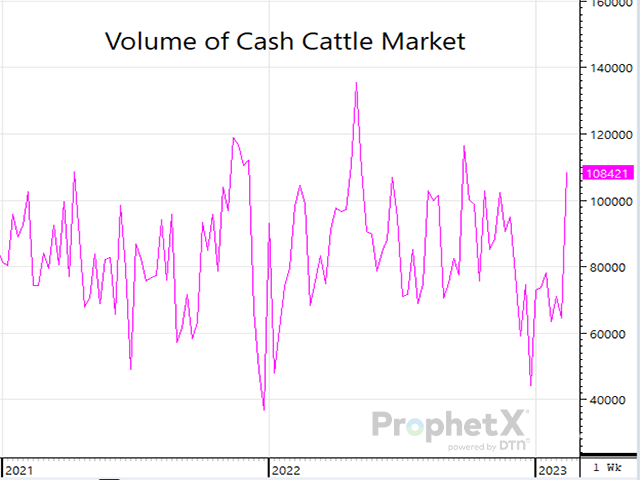

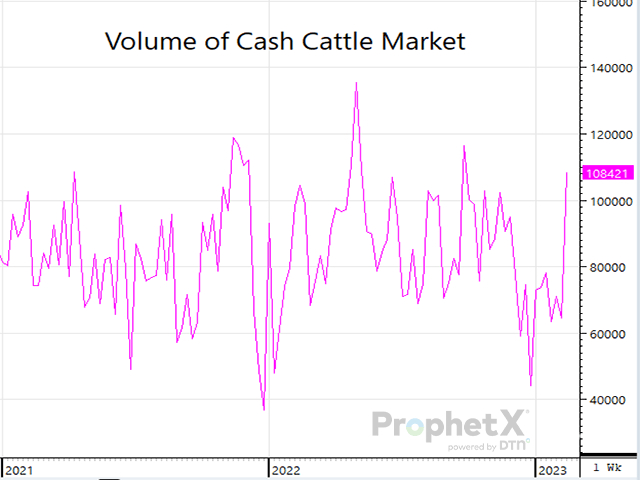

It didn't take long for packers to see the writing on the wall for this spring's cash cattle market before they bit the bullet and dove aggressively into the cash market. Last week's negotiated cash cattle trade totaled 108,421 head. Of that 75% (81,474 head) were committed for nearby delivery while the remaining 25% (26,947 head) were committed for deferred delivery.

It's extremely rare to see the cash cattle market trade over 100,000 head on any given week as packers prefer to have their needs committed to them through grid and formula deals, or through alternative marketing agreements. These other channels serve as vital marketing avenues for feedlots, but none of them would exist without the cash cattle market as most of them are based off the previous week's weighted average cash price, with added premiums and discounts as specified in their agreement.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The largest reasons why packers leaped into last week's cash cattle market as aggressively as they did are: 1) They want to pump the brakes the vigorous momentum that's been driving cash cattle market prices higher over the last month; 2) They want to build inventory so their dependance on the cash cattle market on a weekly basis lessens.

Thankfully fed cattle supplies are extremely thin and demand continues to remain incredibly high. February is typically one of packers' worst months throughout the year in regard to boxed beef profits, but given how strong consumer demand remains, both choice and select cuts trended higher last week than the week before. Last week, choice cuts averaged $267.89 (which is $2.07 higher than the previous week) and select cuts averaged $254.50 (which is $2.00 higher than the previous week).

Packers have cut back production speeds to maintain and control margins, but with demand as strong as it is, they'll want to keep enough product on the shelves for consumers who are willing to part with their cash.

Needless to say, this week's cash cattle market should trade at least steady; but it's unlikely the market will again see a $4.00 advancement as packers have somewhat protected themselves from having to abundantly support the cash market.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .