Sort & Cull

Cattle Charge Into First Full Week of Trade for 2023

As the live cattle and feeder cattle contracts charge into the first full week of trade for the new year, bullish tones engulf the cattle complex.

Last week's market allowed both the live cattle and feeder cattle markets to dip their toes into the new calendar year, but as we now approach the second week of January, there's firm consensus throughout the marketplace that both markets have their eyes set on higher prices.

The live cattle market performed exceptionally well last week as the cash complex held its own; boxed beef prices continued to trend higher, which consequently incentivizes packers to run vigorous processing speeds.

Last week, Southern live deals were marked at $157, which is steady with last week's weighted average, and Northern dressed cattle traded for mostly $252, which is $0.50 higher than the previous week's weighted average.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Cash cattle prices are expected to trade higher again this week, and the market will be especially concerned about how many cattle trade and for what delivery option packers are able to commit the cattle.

It was eye-opening to see last week's carcass data -- it clearly showed that front-end supplies of market-ready cattle are thin and choice-plus grades of cattle will likely keep their premium, as there simply aren't as many of them available in the market.

For the week ending Dec. 24, steers averaged 920 pounds, which was 7 lbs less than the previous week, and 5 lbs less than the same week a year ago. For the same week, heifers averaged 844 lbs, which was down 2 lbs from the previous week and 6 lbs lighter than the same week a year ago. For this upcoming week, showlists are lower in all three major feeding states.

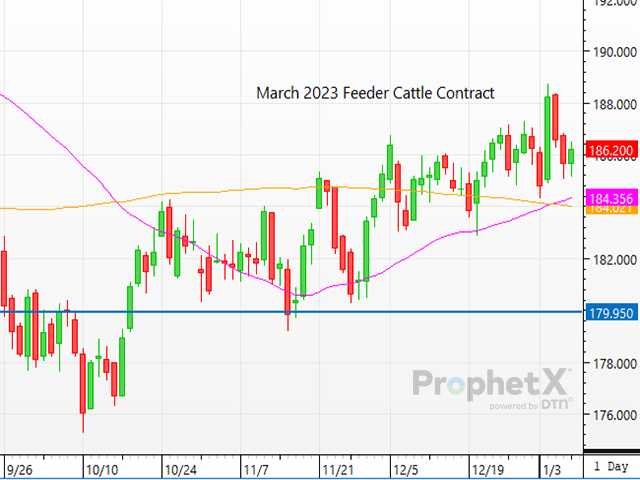

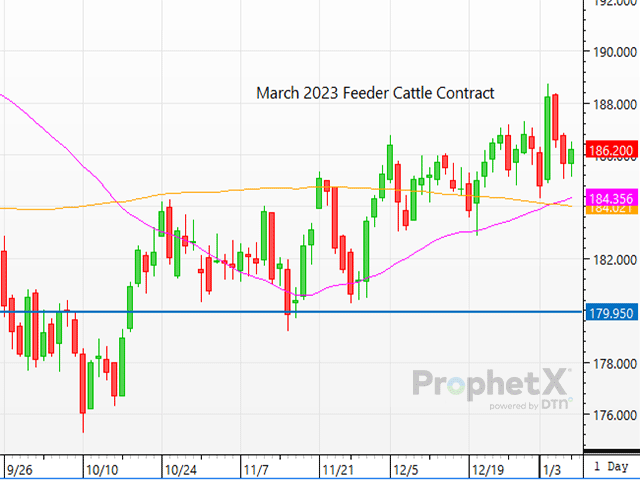

The feeder cattle market charged sharply higher last Wednesday, and tested levels not last seen since August 2022, but as the week traded on, traders grew less interested in maintaining that price point and consequently the market closed mostly steady.

Thankfully, the recent drop in corn prices has helped the feeder cattle market look more appealing to both traders and cattle buyers as profitability continues to be a concern in the feeding sector. But as the days pass by and winter grows closer to spring, feeder cattle prices will undoubtedly grow stronger as feedlots soberly understand that there simply aren't as many cattle to be had this year as compared to years past.

In the past, one has been able to examine the spread in the April live cattle contract compared to the price of the June live cattle contract and see that it correlates to the price difference between feeder steers and heifers.

If that trend holds true in this year's market, there is currently only a $4 difference between the April 2023 and June 2023 live cattle contract -- whereas a $7-to-$12.00 spread has been noted in other years. This means that in the days to come, because there are significantly fewer feeder cattle to be had, and because the female replacement markets are likely to be hot, don't expect a big spread in steer and heifer prices.

As we work our way through January and look to the rest of what 2023 may bring, I'm still extremely optimistic for both the live cattle and feeder cattle market. The fundamental outlook for the market is extremely supportive, and traders are showing increasing interest in the contracts as time passes by.

ShayLe Stewart can be reached at shayle.stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .