Once again, the spot Canadian dollar has failed to sustain a move above its 100-day moving average. A continued sell-off in crude oil is viewed as a bearish feature while this week's focus will be on the U.S. rate decision.

Once again, the spot Canadian dollar has failed to sustain a move above its 100-day moving average. A continued sell-off in crude oil is viewed as a bearish feature while this week's focus will be on the U.S. rate decision.

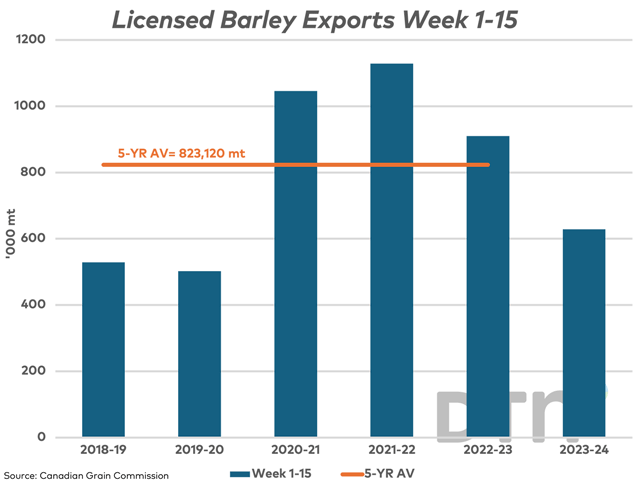

Canada's wheat exports as of week 18 are up 12.5% from one year ago while all-wheat exports are up 3% from a year ago. This remains ahead of the pace needed to reach current government forecasts, with a year-over-year increase in volumes reported for some of the largest...

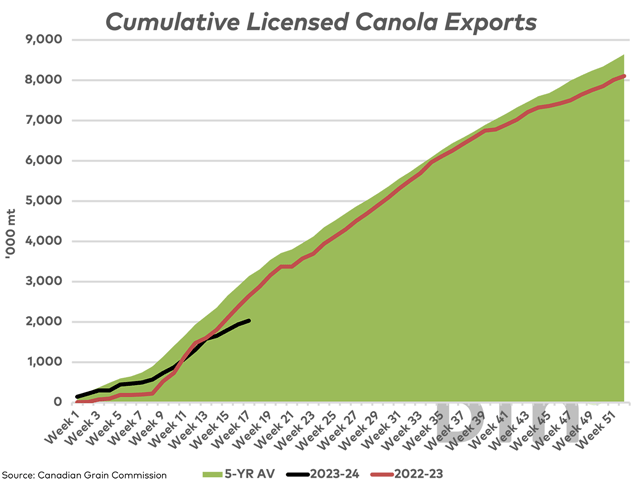

January canola tried to rally for a second day on Dec. 8 but spill-over trade from the WASDE report led to a lower close. Exports remain key to this market.

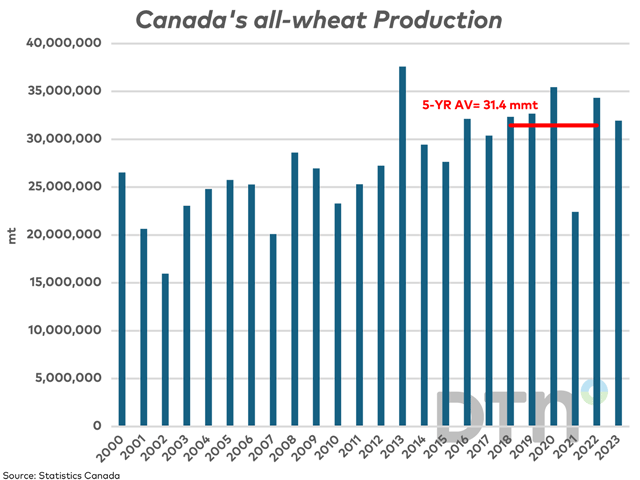

Prairie spring wheat yields landed below their respective 20-year trend in 2023 for the second time in three years.

The following is a look at miscellaneous Canadian trade data for October as it applies to crop and crop product trade.

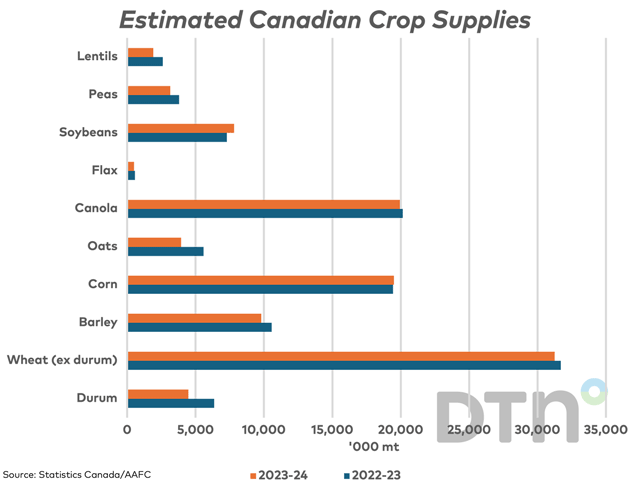

This study looks at the year-over-year change in crop year supplies when factoring in Statistics Canada's revised production estimates.

As widely expected, Statistics Canada revised Canadian grain production upward with the release of the first survey-based results.

A drop in weekly canola exports in week 17 to 87,000 metric tons has seen cumulative exports fall further behind the year-ago and five-year average pace.

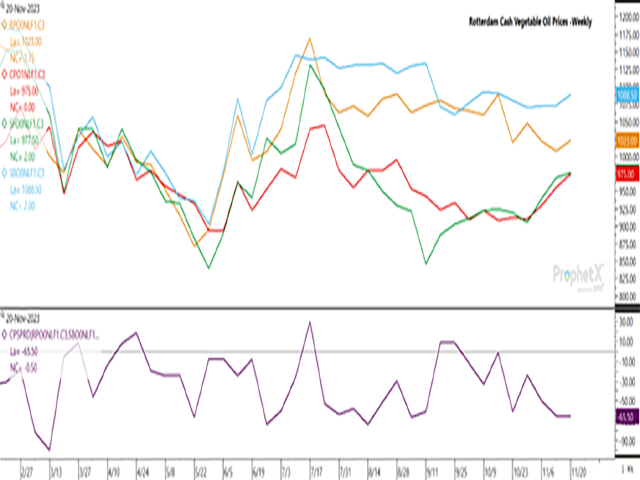

January soybean oil closed lower for a second session on Thursday while failing at the contract's 50-day moving average for a second day.

The Nov. 29 rapeseed trade in Europe led to a break-out higher than the range traded during the past seven weeks.

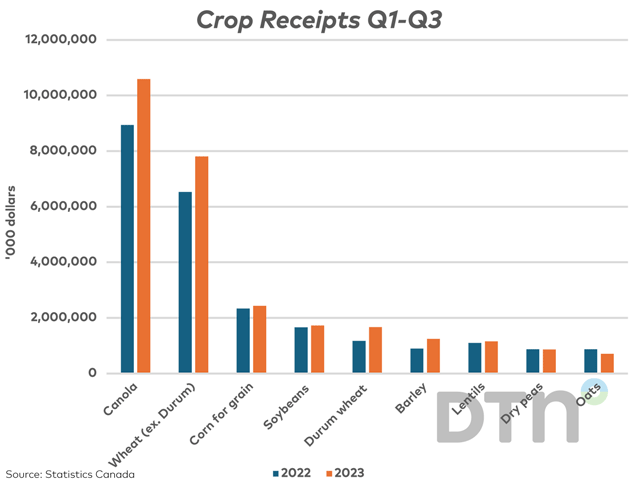

Statistics Canada reported crop receipts over the first three quarters of 2023, or nine months, rose by $4.5 billion from the same period in 2022 to a record level for the period.

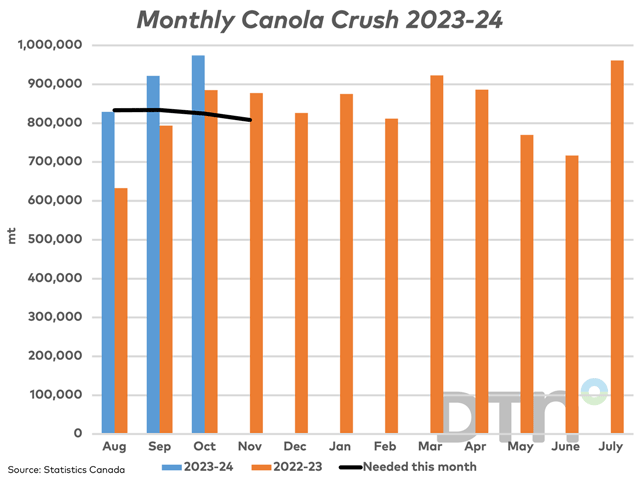

Statistics Canada reported a record canola crush in October while the board crush margin continues to point to historically high returns.

Despite weak futures trade, cash trade for vegetable oils in Europe is showing signs of strength.

The effect of currency moves and government policy across major grain exporters will have implications for markets.

There were very few changes made to AAFC's November supply and demand estimates released this week. The most noticeable changes affected feed supplies.

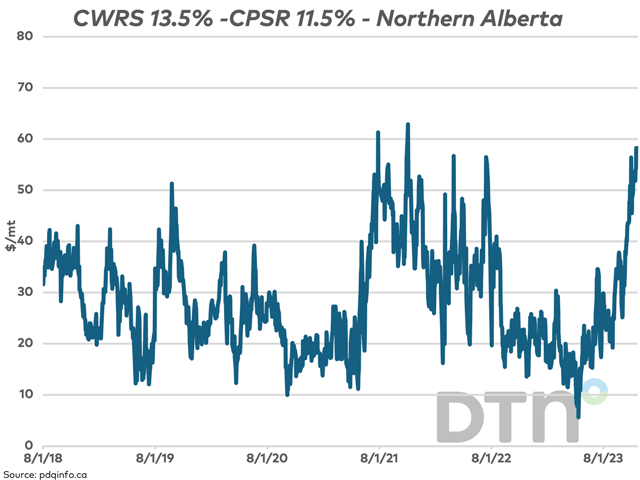

PDQinfo.ca prairie price data as of Nov. 20 shows the Canada Western Red Spring 13.5%/Canada Prairie Spring Red 11.5% spread at the widest seen since in over two years. The move in the spread between the two cash indices in the U.S. would indicate the spread could continue to...

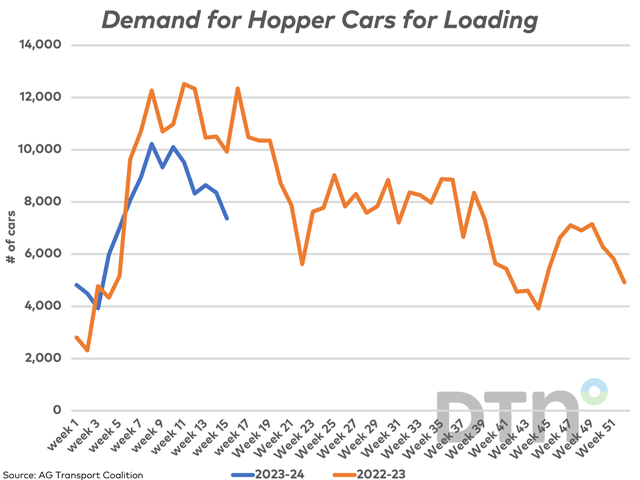

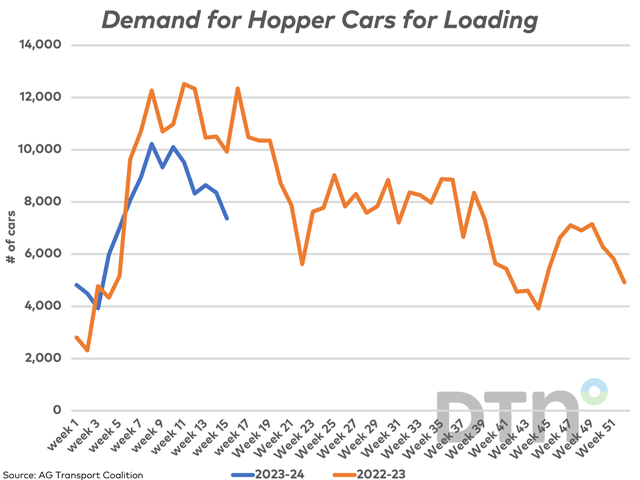

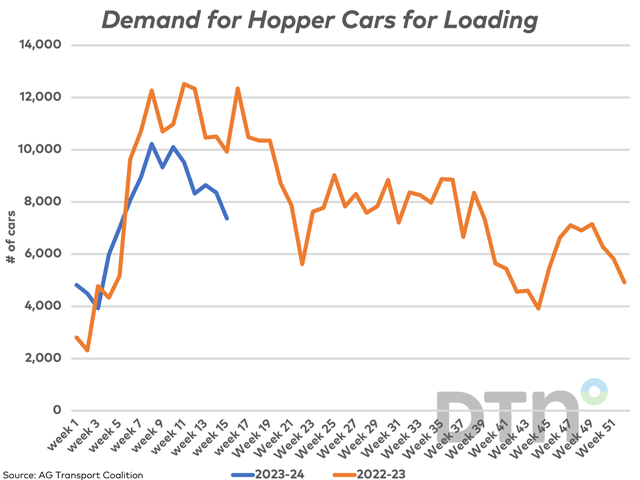

Major Prairie shippers requested 7,369 cars for loading in week 15, the smallest number requested in 10 weeks. In 2022-23, this demand trended lower over the balance of the crop year.

Major Pprairie shippers requested 7,369 cars for loading in week 15, the smallest number requested in 10 weeks. In 2022-23, this demand trended lower over the balance of the crop year.

Major prairie shippers requested 7,369 cars for loading in week 15, the smallest number requested in 10 weeks. In 2022-23, this demand trended lower over the balance of the crop year.

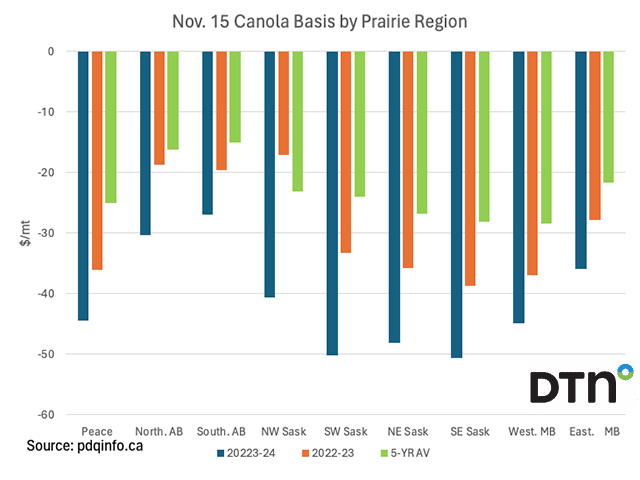

Canola basis has shown modest signs of strength across almost all regions of the Prairies this month, although remain weaker on Nov. 15 than reported one year ago and when compared to the five-year average for each of the nine prairie regions.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]