Canada Markets

May Canola Shows Potential Signs of Stabilizing

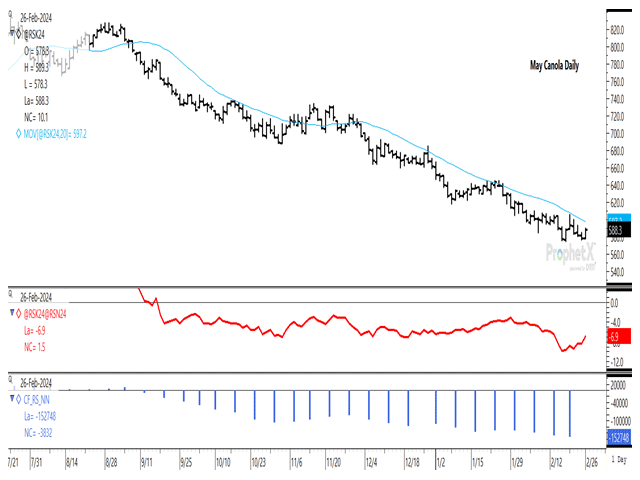

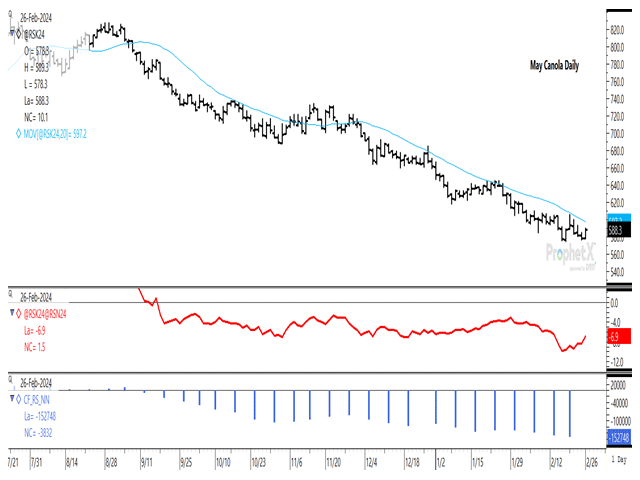

The May canola contract settled $10.10/metric ton higher at $588.30/mt on Feb. 26, the first higher close in four sessions and the largest daily gain seen in five sessions. Gains in palm oil, crude oil and modest weakness in the Canadian dollar against the USD were supportive features this session, along with a late-session bounce in soybean and soybean oil futures, which also ended higher.

The Feb. 23 session saw contract lows reached for soybeans, soybean oil and soymeal, while March soybeans reached another contract low on March 26. Canola futures showed signs of stabilizing during the week, ending $9.50/mt lower over the week, a fifth consecutive weekly loss, while the week's low of $576/mt landed $1/mt above the contract low reached on Feb. 16.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Further positive signals were seen in Monday's trade, with canola for May delivery opening slightly higher than Friday's close, while spending the entire session in positive territory. This compares to soybeans and soybean oil that traded lower overnight, with late-session buying interest pushing prices to a higher close.

Nearby resistance lies at the contract's 20-day moving average at $597.20/mt, along with psychological resistance at $600/mt. Long-term support lies at $552/mt, a weekly low seen on the continuous active chart reached for the week of Feb. 1, 2021.

The red line on the first study shows the May/July contract spread narrowing by $1.50/mt this session to minus $6.90/mt, well above the minus $9.80/mt reached on Feb. 15 of this month. While not shown, the latest CFTC shows commercial traders holding a record net-long position of 153,242 contracts.

The blue bars on the lower study shows noncommercial traders increasing their bearish net-short position in canola futures for a third week over the week ending Feb. 20 to a record bearish position of 152,748 contracts net-short. The test for this market will be the resolve of the speculative trader and the potential for something to rattle this market and force short-covering.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .