Canada Markets

Slowing Demand for Hopper Cars May Continue

CN Rail's Vice President of Grain David Przednowek told Discover Moose Jaw that the company is seeing waning demand for hopper cars for loading on the Prairies. He points to seasonal factors such as increasing temperatures, producers heading to the fields and "the fact that there's just less and less grain available for movement as we get deeper and deeper into the crop year."

He also pointed to a short-lived disruption at a Vancouver grain terminal as a result of the recent government worker strike but indicated "We didn't see any dramatic impact of the labour disruption in terms of overall grain movement." He goes on to indicate that cars are being parked, while slower movement could continue "unless something really dramatic changes in terms of the demand outlook."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

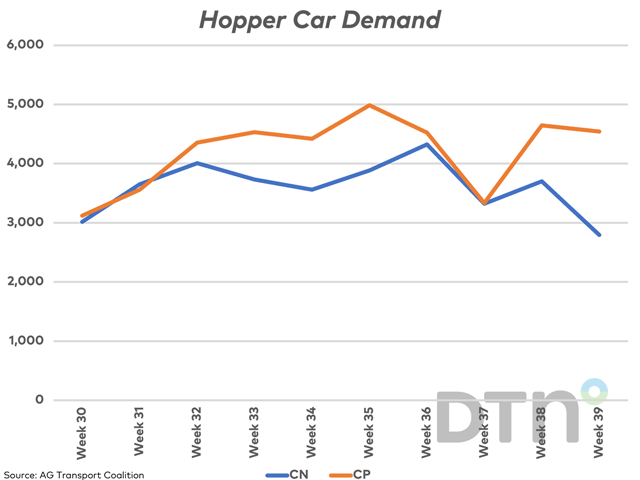

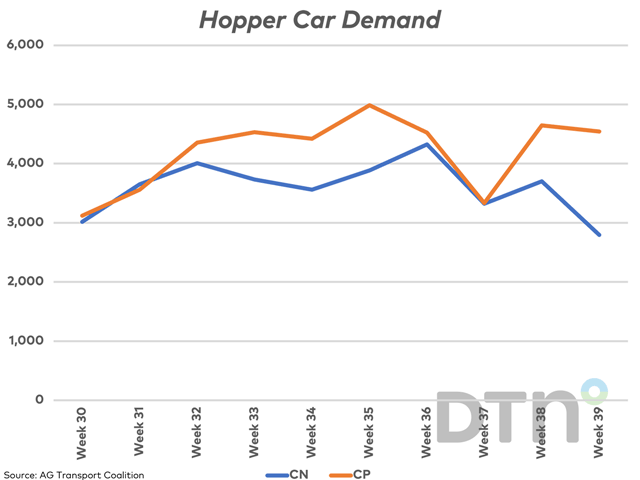

As seen on the attached chart, compiled with AG Transport Coalition data representing the largest shippers on the prairies, demand for CN hopper cars for loading in week 39 fell to 2,795 cars, down 1,012 cars or 26.6% from the four-week average, while the lowest number reported since week 5, or 34 weeks. Demand on CP track has shown resilience, with 4,541 cars wanted for loading in week 39, up 3.8% from the four-week average.

The AG Transport Coalition Daily Network Status Report as of May 10 shows a further slowing, with total loads on wheels for all railways at 5,280 cars, while the daily average so far in week 41 of 5,747 cars is down 24% from the previous week. The daily average western port unloads is seen at 856 cars so far this week, down 24% from the previous week.

The Grain Marketing Program's Weekly Performance Update shows that week 39 producer deliveries into licensed facilities increased week-over-week for the first time in five weeks, although there is continued pressure on country stocks. Week 39 data shows total prairie grain stocks down 24% from last year and 17% below the three-year average for this week. While Manitoba's grain inventory is 5% above last year and the B.C. inventory is up 18%, the Saskatchewan inventory is down 38% from a year ago and the Alberta inventory is 16% below last year.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .