Canada Markets

A Deeper Dive into the USDA's Global Wheat Stocks

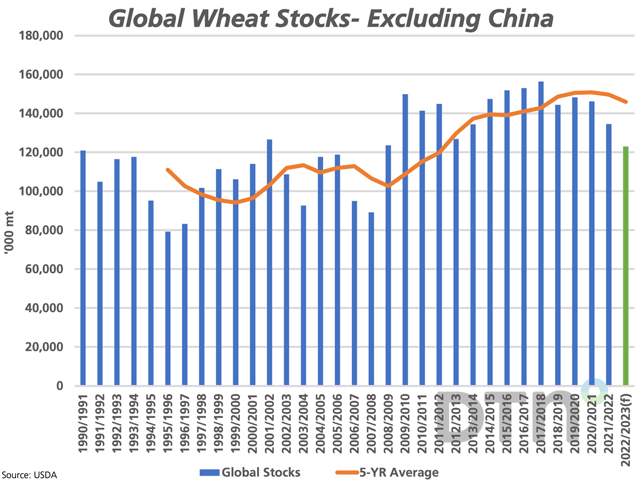

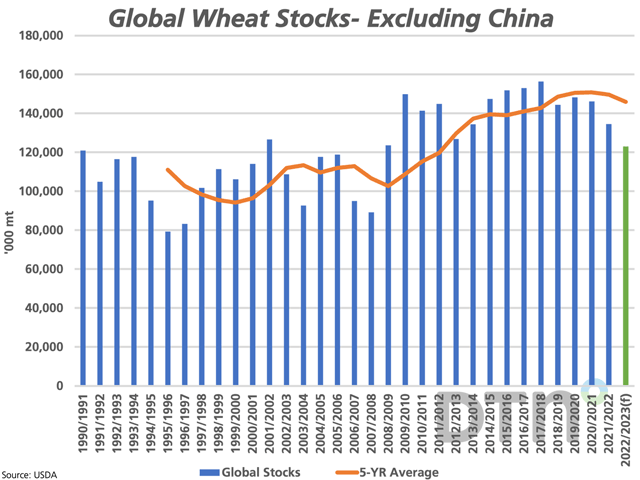

While there are a lot of moving parts in today's USDA WASDE global estimates for 2022-23 wheat, a quick look at the ending stocks estimate shows this volume revised 180,000 metric tons lower this month to 267.34 million metric tons, which would be a third consecutive drop and the lowest in six years, according to USDA data.

As indicated by DTN Lead Analyst Todd Hultman in today's post-report webinar, a focus on the USDA's data that nets out China's data tell a completely different story. China's stocks account for 54% of total global stocks in today's report, while no one knows if they exist and the quality of the grain in question, while these stocks will not be made available to global buyers in export markets.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Today's USDA data shows a downward reduction in global stocks (less China) of 3.02 mmt to 122.98 mmt, shown by the green bar on the attached chart. This is not only falling for a third straight year, but also to the lowest seen since 2007-08, or 15 years. This volume is close to 23 mmt below the five-year average.

Crop year stocks as a percentage of use is calculated at 33.9% when based on total global stocks and estimated use, while falls to 19% when China's data is excluded.

Add to this the uncertainty of moving grain out of Ukraine this year, wheat markets are even more bullish. When the CFTC data for the three wheat futures are combined, the overall noncommercial long position continued to fall in the week ending August 9, while it may be only a matter of time before the speculative trade shifts focus to fundamentals.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .