Technically Speaking

Soy Complex Bowing to Bearish Pressures

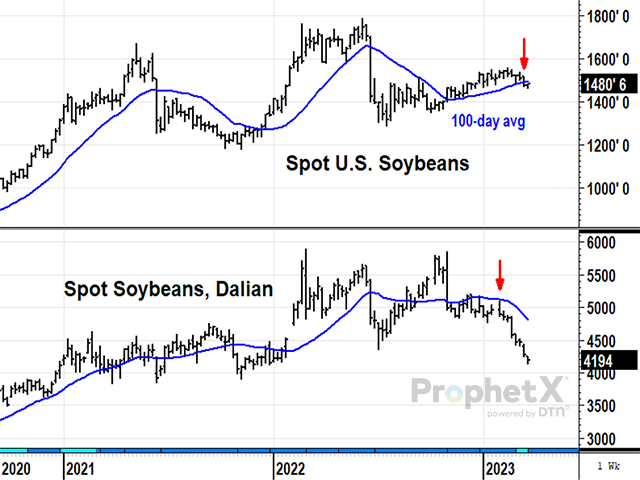

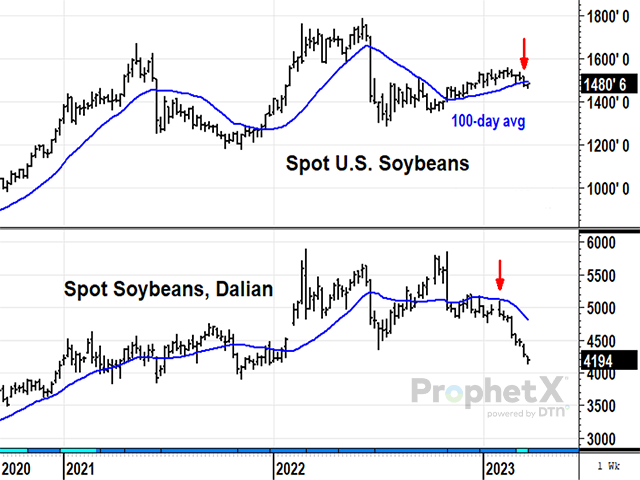

May soybeans fell 30 1/2 cents in the latest week ended Friday, March 17, at $14.76 1/2, the lowest close in 2023 and below the 100-day average at $14.88 for the first time since October 2022. Prices are trading modestly higher Monday morning, but there appear to be several arguments adding to the recent bearishness in soybean prices. In addition to Brazil's record soybean harvest making progress and adding competition to exports, China's soybean prices have been falling in the month of March and closed at their lowest Chinese price in seven months Monday, ending at the U.S. equivalent of $16.57 a bushel. Not only are Brazil's cheaper soybeans becoming available, but it is possible China has a demand problem with reports of African swine fever being circulated. Also, CFTC data shows noncommercial net longs at 180,199 as of March 7, a big bullish bet that could turn bearish with worries about the banking system. Technically speaking, May soybeans have lost their upward momentum and the trend has turned down for the first time in 2023.

SOYBEAN MEAL:May soybean meal fell $19.90 to $466.00 in the week ended March 17, the lowest close in over a month by a slim margin and is roughly steady Monday morning. Prices are still above the 100-day average at $447, but the weekly stochastic for spot meal prices has turned lower, leaving a weekly reversal with a high of $508.20 as the possible peak of this move. Prices first reached above $500 a short ton in 2012 and have only been able to briefly hold that high level since. Domestic demand for meal has been strong until recently, but noncommercials recently held a record amount of net longs and are now feeling the pressure of banking worries and what that might mean for the economy. Technically, the trend remains up in meal, but beware as momentum indicators are looking bearish at an extremely high price level.

SOYBEAN OIL:May soybean oil survived a bearish week for most commodity prices with a gain of 0.85 cent on March 17, ending at 57.46 cents, possibly finding support from its lowest prices in seven months. It was also a week in which May palm oil was down nearly 3% and May ultra-low sulfur diesel was down over 6%. On a weekly chart, spot soybean oil posted a weekly reversal last week near its lowest prices in over a year, not quite reaching the July low of 54.42. Given the weekly reversal and unusual show of support in an otherwise bearish week for oils, May soybean oil deserves watching for a possible bullish change in trend -- not something one would expect with headlines focused on banking problems and the sell-off of energy prices. The 100-day average is currently at 63.16 cents per pound.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .