Technically Speaking

Weekly Analysis: Energy Markets

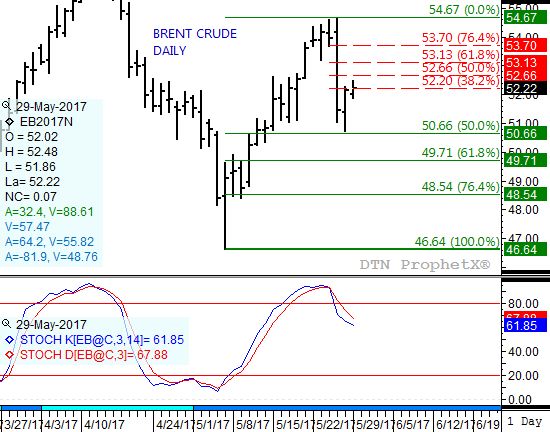

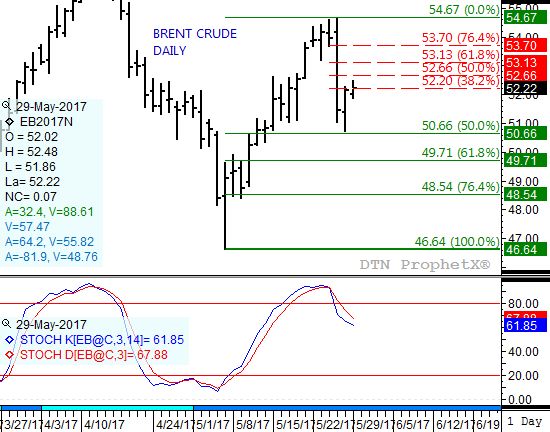

Brent Crude Oil: The spot-month contract closed $1.46 lower at $52.15. The market's minor (short-term) trend looks to have turned down, meaning its secondary (intermediate-term) downtrend could also resume. The spot-month contract rallied off minor its test of support at $50.66 to test initial resistance at $52.20. If this is Wave B (second wave) of a minor downtrend the contract could test next resistance at $52.66 or $53.13 before peaking. From there, Wave C would be expected to extend to at least next support at $49.71, then possibly $48.54.

Crude Oil: The spot-month contract closed $0.53 lower at $49.80. The market is in a three-wave minor (short-term) downtrend with a Wave A (first wave) low of $48.18. Wave B is already testing resistance at $50.09, with further resistance pegged at $50.54 and $51.10. Following the Wave B peak the contract could extend the downtrend to next support between $47.88 and $46.91.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 1.94cts lower at $1.5633. The market is in a three-wave minor (short-term) downtrend with a Wave A (first wave) low of $1.5300. Wave B is already testing resistance at $1.5785, with further resistance pegged at $1.5899 and $1.6040. Following the Wave B peak the contract could extend the downtrend to next support at $1.5009.

Gasoline: The spot-month RBOB gasoline contract closed 0.97ct lower at $1.6426. The market's secondary (intermediate-term) trend remains sideways on its weekly chart while its minor (short-term) trend looks to have turned down last week. Daily stochastics established a bearish crossover above the overbought level of 80% at the close of Thursday, May 25.

Ethanol: The spot-month contract closed 3.7cts higher at $1.520. While the secondary (intermediate-term) trend remains sideways, the market's minor (short-term) trend is up. Next resistance is at $1.530, a price that marks the 38.2% retracement level of the previous minor downtrend from $1.692 through the low of $1.43. The 50% retracement level is up at $1.561.

Natural Gas: The spot-month contract closed 2.0cts lower at $3.236. The secondary (intermediate-term) trend remains down with the recent high of $3.431 looking to be the Wave B (second wave) peak of a 3-wave downtrend. If so the spot-month contract would be expected to take out the Wave 1 low of $2.521 over the coming weeks.

Propane (Conway cash price): Conway propane closed 1.00ct lower at $0.6288. The secondary (intermediate-term) trend remains up with cash propane testing initial resistance at $0.6537. This price marks thee 33% retracement level of the previous downtrend from $0.9100 through the low of $0.5275. The 50% retracement level is up at $0.7188.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .