Technically Speaking

Weekly Analysis: Livestock Markets

Live Cattle: The April contract closed $3.45 higher at $139.80. The secondary (intermediate-term) trend remains up with the futures contract above resistance at $139.025. This price marks the 50% retracement level of the previous downtrend from $155.00 through the low $123.05. Though weekly stochastics are nearing the overbought level of 80%, bullish short-term fundamentals indicated by the April-to-June futures spread indicate a possible test of the 67% retracement level near $144.35.

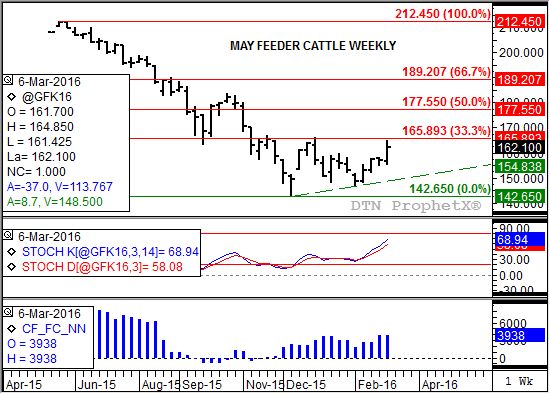

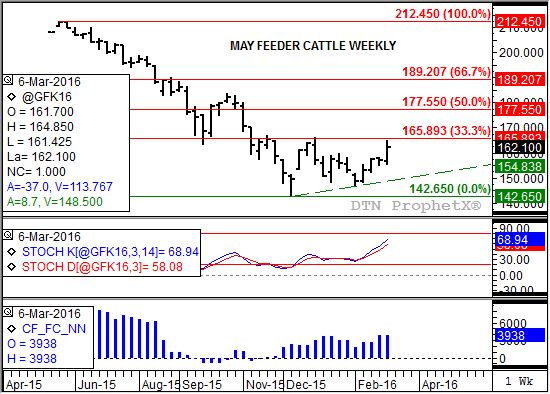

Feeder Cattle: The more active May contract closed $4.925 higher at $162.10. The secondary (intermediate-term) trend remains up with initial resistance near $165.90. This price marks the 33% retracement level of the previous downtrend from $212.45 through the low of $142.65. Weekly stochastics remain bullish below the overbought level of 80% indicating the futures contract should be able to extend the uptrend through its previous high of $166.075. Friday's CFTC Commitments of Traders report showed noncommercial traders increasing their net-long futures position by 125 contracts, putting it at 3,938 contracts.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean hogs: The April contract closed $1.025 higher at $71.825 last week. The futures contract extended its secondary (intermediate-term) uptrend, closing above resistance near $71.05. This price marks the 76.4% retracement level of the previous downtrend from $74.70 through the low of $59.225. Weekly stochastics remains well above the overbought level of 80% indicating renewed selling could soon emerge. However, the major (long-term) uptrend could extend to its next target price near $78.80.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.38 1/2, up 7 1/2 cents for the week. The secondary (intermediate-term) trend remains sideways with support near $3.29 and initial resistance near $3.49 1/2. Weekly stochastics are neutral above the oversold level of 20%. National average basis strengthened by a 1/2 cent last week with Friday's NCI.X coming in about 26 1/2 cents below the close of the May futures contract. The 5-year average for national average basis last week is 21 cents under with the 10-year average calculated at 23 cents under.

Soybean meal: The May contract closed $2.60 higher at $273.50. The recently established secondary (intermediate-term) uptrend continues to strengthen with initial resistance pegged at $279.10. This price marks the 23.6% retracement level of the previous downtrend from $344.60 through the low of $258.90. Friday's CFTC Commitments of Traders report showed noncommercial traders covering 22,421 contracts of their net-short futures position.

*The weekly Commitments of Traders report showed positions held as of Tuesday, March 8.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .