Technically Speaking

NSI.X: More Bullish Signals for Cash Beans

If 2015 is remembered for nothing else, at least as far as grain markets are concerned, it could be for the continued failure of technical signals, particularly in the soybean market. With that in mind, let's take a look at the latest bullish pattern posted by the DTN National Soybean Index (NSI.X, national average cash price).

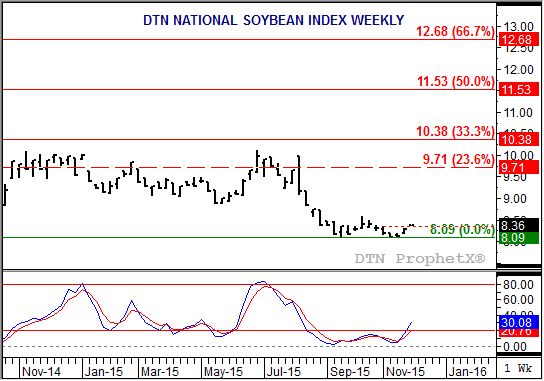

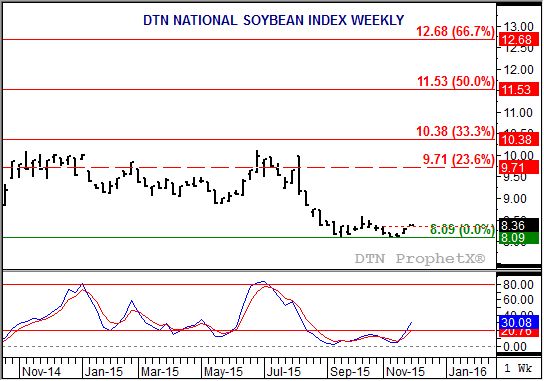

The NSI.X has been trending sideways on its weekly chart since it posted a low of $8.09 the week of September 21, 2015. This coincided with a bullish crossover by weekly stochastics (bottom study), meaning the faster moving blue line crossed above the slower moving red line with both below the oversold level of 20%. An initial rally took the NSI.X to a high of $8.57 (week of October 12) before it fell back to a low of $8.09 the week of November 9. Since then though, the market has stabilized.

Read that recap closely again. Notice that the two weekly lows (weeks of September 21 and November 9) were both at $8.09. This established a double-bottom pattern with an interim high of $8.57, creating a range of $0.48. Last week (week of November 23) saw a secondary (confirming) bullish crossover by weekly stochastics again indicating the intermediate-term trend was now up. The market just needed a bullish breakout to confirm.

Monday evening looks to have provided just such a breakout. The solid rally by the futures market as November came to a close led to the NSI.X being calculated at $8.36. This is above the previous 4-week high of $8.34 (dotted red line). Next resistance is at the interim high of $8.57. If the NSI.X gets above that market the next target would be $9.05. This price is arrived at by flipping the previous range ($0.48) and adding it to the bullish breakout point ($8.57).

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .