Technically Speaking

Weekly Analysis: Grain Markets

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.43, down 18 cents for the week. Cash corn has collapsed after the NCI.X established a bearish reversal the week of July 13. This came on the heels of testing resistance at $4.08 with a calculated high of $4.06. Longer-term support remains at $3.31 with the previous low down at $3.29.

Corn (Old-crop): The September contract closed 21.50cts lower at $3.71. Sep corn has posted a sharp sell-off from its high of $4.43 1/4 posted almost three weeks ago. The sell-off has taken the contract well below support near $3.82 1/2, a price that marks the 67% retracement level of the rally from $3.54 1/4 through the $4.43 1/4 high. This puts next support at the previous low.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Corn (New-crop): The December contract closed 21.50cts lower at $3.81 1/4. Dec corn has posted a sharp sell-off the last three weeks, falling below support near $3.84 1/4. This price marks the 76.4% retracement level of the rally from $3.64 1/4 through the high of $4.54 1/4. The latter was a test of resistance marking the 38.2% retracement level of the previous secondary downtrend. If the "Moves of Three" Theory holds true, then the past move against the secondary (intermediate-term) uptrend should have ended with last week's close. However, most technical indicators have turned bearish indicating Dec corn could possible test its previous low.

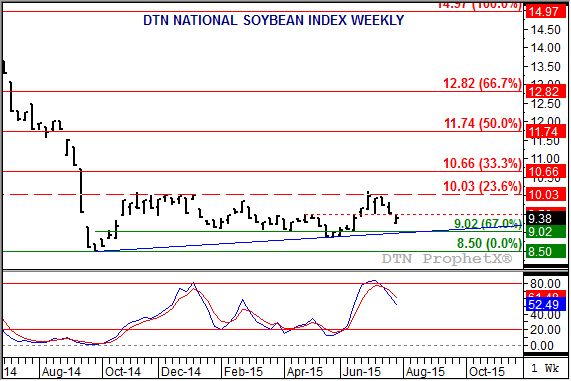

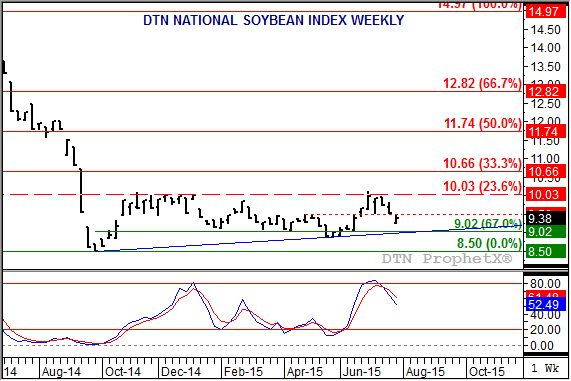

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $9.38, down 15 cents for the week. The secondary (intermediate-term) trend is sideways to down after the NSI.X posted a new 4-week low of $9.24 last week. However, there is a slight chance cash soybeans could establish a bullish island reversal on its weekly chart if is calculated Monday afternoon above last week's high of $9.50. To do so the market will need to rally at least 13 cents.

Soybeans (Futures): The November contract closed 24.75cts lower at $9.40 1/4 last week. The secondary (intermediate-term) trend is sideways-to-down with Nov beans testing support near $9.31. This price marks the 76.4% retracement level of the previous rally from $8.95 3/4 through the high of $10.45. Though weekly stochastics remain neutral to bearish, Nov soybeans could see support on the same "Moves of Three" Theory discussed in the Dec corn analysis. Renewed support could come from the long-term bullish commercial outlook reflected by the market's inverted forward curve.

Wheat (SRW Cash): The DTN National SRW Wheat Index (SR.X, national average cash price) closed at $4.43, down 10 cents for the week. There are no conclusive secondary (intermediate-term) trend signals on the weekly chart. Nevertheless the SR.X is testing its previous low of $4.38. The major (long-term) trend is sideways.

Wheat (HRW Cash): The DTN National HRW Wheat Index (HW.X, national average cash price) closed at $4.47, down 15 cents for the week. The sharp continues with the HW.X falling below its previous low of $4.49. While it could prove to be a head-fake, both the secondary (intermediate-term) and major (long-term) trends now look to be down.

Wheat (HRS Cash): The DTN National HRS Wheat Index (SW.X, national average cash price) closed at $4.72, down 21 cents for the week. Cash HRS moved to a new low 5-year low last week, keeping both the secondary (intermediate-term) and major (long-term) trends down. Next support could be found between $4.72 (low from June 2010) and $4.45 (low from September 2009).

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .