Technically Speaking

What Goes Up, Must Come Down

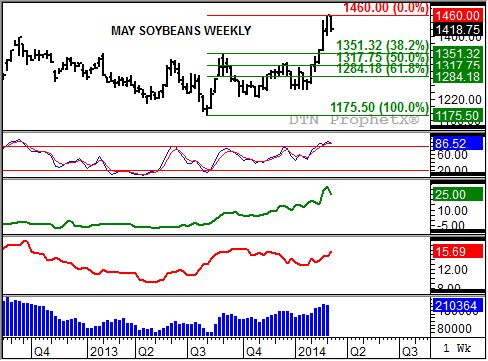

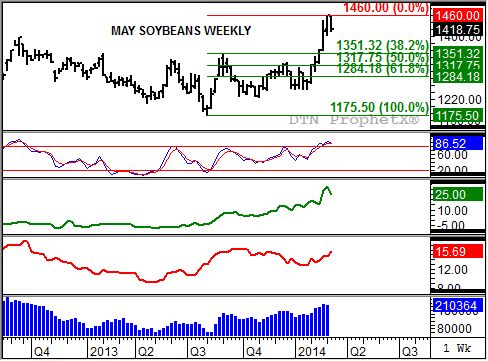

It seemed almost inevitable that the soybean market would come under pressure. The May contract has rallied from a low of $11.75 1/2 (week of August 5, 2013) through last week's high of $14.60, a gain of almost $3.00. Support has come from both sides of the market, with unquenchable export demand reflected in the strengthening inverse of the May to July futures spread (third study, green line) as it closed at 33 cents last week, while noncommercial traders continued to build their net-long futures positions (bottom study, blue histogram) as reported by weekly CFTC Commitments of Traders reports.

But all things eventually come to an end, if short-term for nothing else. That seems to be the case as Monday's trade saw the May contract close down 40 cents from Friday's settlement. Many will point to the March USDA Supply and Demand report as the catalyst, though that report was actually bullish (for more information, see the latest On the Market column).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The real spark to what could be a minor (short-term) downtrend is technical rather than fundamental, though the possible change in trend in the May to July futures spread needs to be watched closely. Weekly stochastics (second study) had moved into an overbought situation, with both lines near 90% as of last Friday's close. Usually when this occurs, it leads to a round of noncommercial long-liquidation. If you take a close look at the CFTC numbers (blue histogram), last Friday's report showed this group whittling their net-long position (as of Tuesday, March 4) to 210,364 contracts, down 1,452 contracts from the previous week.

May soybeans could establish a secondary (intermediate-term) downtrend this week, depending on if stochastics see a bearish crossover above 80%. If so initial support is pegged near $13.51 1/4, a price that marks the 38.2% retracement level of the previously mentioned uptrend. Even if a secondary downtrend is not established, the market could still see a minor (short-term) downtrend due to similar signals on the contract's daily chart.

To track my thoughts on the markets, follow me on Twitter: www.twitter.com\DarinNewsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .