Technically Speaking

Crude Oil's Slippery Slope

Exactly three months ago, July 23, I posted a blog talking about how crude oil looked to be moving into its seasonal downtrend ("Seasonal Sell-Off in Crude Oil"). As we look at the market this morning, October 23, we see that the spot-month contract is in free-fall mode.

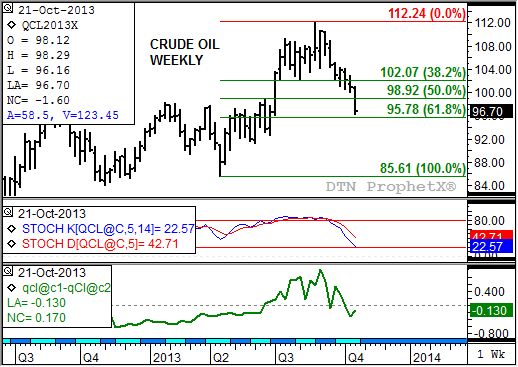

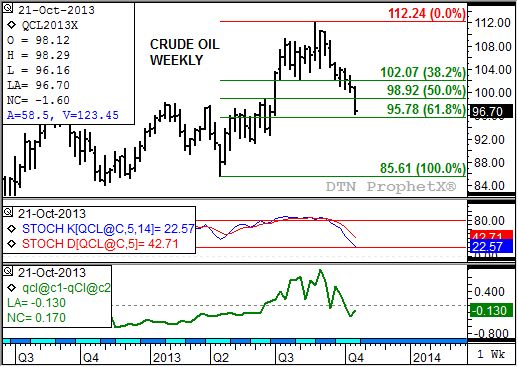

A look at the weekly chart for crude oil shows the market has not only been following its seasonal tendencies, but its technical patterns as well. As the spot-month contract posted a spike high in late August of $112.24, before settling at "only" $107.65 that week, weekly stochastics (second study) established a bearish crossover above the overbought level of 80% confirming the idea that a seasonal sell-off was coming.

Since then the market has been falling fast, reaching a low (so far) this week of $96.16. Notice that this is nearing a test of support at $95.78, a price that marks the 61.8% retracement level of the previous uptrend from $85.61 through the August high of $112.24.

But what if the seasonal index is right and we see a 20% decline from its normal seasonal peak (weekly close only) in mid-July through the low in early December. As discussed in the previous blog post, using the then high close of $108.05 projected to a low weekly close of $86.44. If you take another look at the chart and do some projecting, this could imply a possible test of the previous low ($85.61), possibly on a sell-off, before rallying slightly into the weekly close.

Other indicators that the market could continue to come under pressure are again weekly stochastics and the solid downtrend see in the nearby futures spread (bottom study). The former (weekly stochastics) are approaching the oversold level of 20% but has plenty of downside yet. The downtrend in the nearby futures spread, indicating an increasing bearish supply and demand situation, has taken it from a backwardation (inverse) of $1.01 (week of September 3) to a contango (carry) of $0.30 (week of October 14). The slight uptick in the spread this week is due to the expiration of the November contract, moving the December to January spread into the role of nearby.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .