Fundamentally Speaking

U.S. Soybean Export Pace

There seems to be a lot more optimism around potential Chinese purchases of U.S. soybeans due to the phase 1 trade agreement that will be inked later next month in Chile at the APEC summit.

In addition, there is word China will allow another 10.0 million metric tons (mmt) of tariff-free soybeans from the U.S. to be purchased if demand and price warrant such buys.

On the other hand, the spread of African swine fever, word that Chinese crushers are well supplied to the end of the year, far cheaper South American offers beginning in February, sentiment that it will be a long time if ever before the U.S. regains lost China market share, and general distrust on a number of issues suggest our soybean exports could be soft for the foreseeable future.

Through the second week of October, U.S. overseas soybean sales for this marketing year beginning Sept. 1 are a mere 660.8 million bushels (mb) which, according to our records, is the lowest ever for this time of year going back to the 2009/09 season.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The amount shipped as of this date is 183.1 mb, the lowest amount since the 2015/16 marketing year.

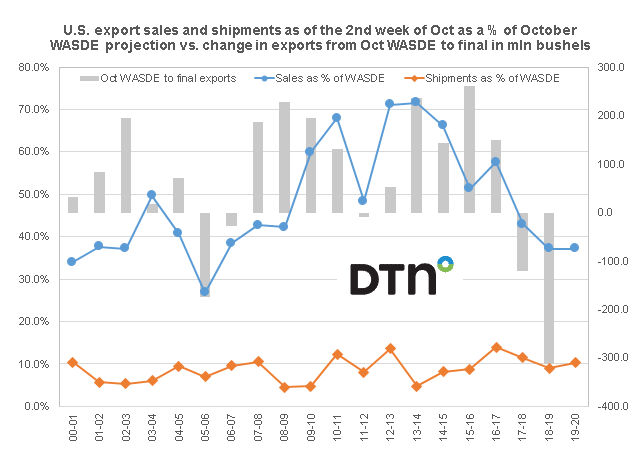

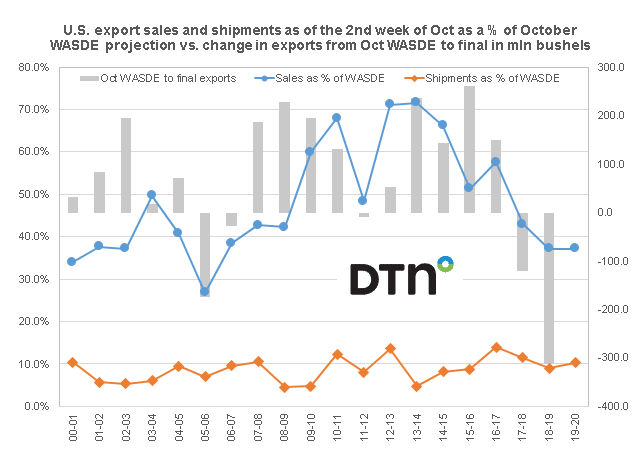

This graphic shows the amount of U.S. soybeans shipped and sold as of the second week of October as a percentage of USDA's October WASDE export projection on the left hand axis.

The change in U.S. soybean exports from that WASDE forecast to the actual final figure for that marketing year is shown on the right hand axis in million bushels.

Using the USDA Oct WASDE forecast of 1.775 billion bushels, this works out to 37.2% of total projected exports as of the second week of October, which along with last year is the lowest percent since the 2005/06 season.

Meanwhile the 10.3% shipped as of this date is actually higher than the average 9.0% pace.

Still the sluggish sales pace suggests downward revisions in projected U.S. soybean exports will be seen in subsequent WASDE reports as last year's similar slow sales pace resulted in final exports 312 million below the October WASDE forecast.

The sales pace was even slower in the 2005/06 season when final exports were 175 million less than 1.115 billion the USDA had projected back in October 2005.

(KLM)

© Copyright 2019 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .