Kub's Den

Best Time of Year to Buy Fertilizer: Seasonal Patterns

What do you suppose would happen if you just didn't fertilize a field of corn? Due to high international fertilizer prices, more than half of farmers in Ghana this summer didn't apply any fertilizer to the corn they will need to feed their own families and all the rest of the citizens of that particular African country. Other farmers applied a lower-than-usual rate of fertilizer and only 10% applied their usual, full rate of fertilizer, according to a survey conducted by Farmerline, an African agritech company, as reported by the Financial Times (https://www.ft.com/…). This does not bode well for coming food supplies on that continent or any other.

It's not a prescription that grain producers are eager to try out here in North America -- not if they can afford to buy crop inputs, one way or another. Fertilizer for the upcoming 2023 growing season will need to be purchased sometime, at some price. The question is when?

We know grain markets behave, in a "normal" year, with some roughly predictable seasonal patterns -- lower at harvest when supplies are abundant, higher in the spring and summer when the crop is at the most risk. But do fertilizer markets behave seasonally? Can we predict the "best" times of year to buy or sell fertilizer?

I believe we can make some predictions.

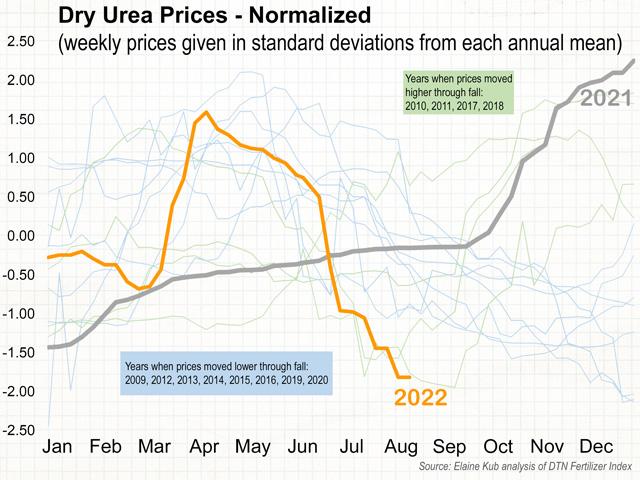

Looking at weekly dry urea prices (therefore focusing on just the price for nitrogen, 46-0-0, in a bulk dry storable, shippable form) over the past 13 years, there are higher z-scores in the data during the March-to-June planting timeframe in a significant pattern, year-after-year. The z-score is a measurement of how many standard deviations each week's price is away from the annual average: 0 would be equal to the mean; +1 would be one standard deviation away from the mean; -1 would be one standard deviation below the mean. Looking at the data this way "normalizes" multiple years of observations with vastly different price levels and allows an apples-to-apples seasonal comparison. It turns out we can generally expect prices will be above the annual average during late March through early June and, in particular, we can expect prices to be about 0.60 times their annual standard deviation above their annual mean sometime around the start of May.

This may not be particularly helpful from a buyer's perspective, except to highlight the time of year when it's best not to make fertilizer purchases. But it's always nice when charts match the physical reality of the markets. As DTN Staff Reporter (and fertilizer guru), Russ Quinn, told me, "Before the past 18 months when prices seemed to only move higher and higher, you used to be able to see fertilizer prices showing a seasonal pattern with a high at planting season, then drop a little bit, then display seasonal upticks during June or July side-dressing operations or in September as retailers would summer fill into fall, then start all over again, all determined mostly by the timing of farmer demand more than supply."

(Read Russ Quinn's latest DTN Retail Fertilizer Trends column here: https://www.dtnpf.com/…)

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Unfortunately, we are all now a little gun-shy about fall fertilizer price patterns, after the shock of 2021's price rally, driven more by sudden supply problems (production plant shutdowns, international phosphorus tariffs, skyrocketing natural gas prices during the Russian invasion of Ukraine) instead of by predictable demand. If we knew prices were going to embark on another unrelentingly upward path from mid-September to next April, then we'd surely want to lock in prices today.

But we don't know and the backwards-looking statistics aren't a very confident guide either.

(Read DTN's latest Fertilizer Outlook column here: https://www.dtnpf.com/…)

By pure numbers, the first week of September has tended to show the lowest z scores: an average of 0.54 times the standard deviation below the annual average. I've averaged the many years' worth of weekly average retail fertilizer prices into monthly average z scores, and if we leave out 2021's bizarre behavior, here is the rough pattern:

| MONTH | AVE ST DEVIATIONS AWAY FROM THE ANNUAL MEAN |

| January | -0.19 |

| February | 0.13 |

| March | 0.45 |

| April | 0.57 |

| May | 0.64 |

| June | 0.29 |

| July | 0.01 |

| August | -0.43 |

| September | -0.45 |

| October | -0.34 |

| November | -0.33 |

| December | -0.38 |

For instance, to get the z score for the week of Sept. 8, 2017, dry urea at $302 per ton was $34 below the 2017 average of $336, and that difference was -1.95 times the 2017 standard deviation of $18 per ton. (Also see consistent findings for urea, anhydrous ammonia and liquid N in Gary Schnitkey's April 2016 (https://farmdocdaily.illinois.edu/…)

I must warn you, however, the z scores during fall were much more scattered throughout the years -- sometimes prices go higher; sometimes prices go lower. There is much less statistical significance in the historical data from the fall months and therefore much less predictive power.

Therefore, it's tricky to use the past as a guide for today's dilemma: Should we book 2023 needs now before hurricane season affects natural gas prices or before fall fertilizer application drives up demand? Or should we wait and expect to see prices continue to dwindle lower, the way they did in 2012, back toward a more typical price level? As Russ Quinn put it, "Boy, it sure goes down a lot slower than it goes up." The price for dry urea, as our benchmark for all nitrogen-based fertilizers, currently averages $812 per ton in the DTN Fertilizer Index, an average of retailer bids across the country. That's almost double the average throughout the previous decade when, with the exceptions of late 2011 and 2012, it never ventured above $600 per ton.

As we all know from last fall, and from the overall inflationary environment we're living in, we may simply be in a totally new price regime. Predictions based on historical data may be inappropriate and unhelpful. Each market participant will choose to handle the uncertainty in their own way. In a fertilizer-related survey closer to home, in July, DTN asked, "With retail fertilizer prices falling in recent weeks, what best describes your fertilizer-buying plans this summer?" and got the following responses:

37% responded, "I will not be purchasing fertilizer anytime soon."

24% responded, "I may purchase fertilizer in a couple of months."

17% responded, "I usually purchase fertilizer at the end of the year."

11% responded, "I have already purchased some of my fertilizer needs."

10% responded, "I may purchase fertilizer within the next month or so."

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2022 DTN, LLC. All rights reserved.