DTN Retail Fertilizer Trends

UAN Fertilizers Again Lead Prices Lower

OMAHA (DTN) -- Retail fertilizer prices continue to shift lower according to prices tracked by DTN for the first full week of February 2023. This trend has been since the last week of December 2022.

As has been the case in the last several weeks, seven of the eight major fertilizers are lower compared to last month. Of these seven, four fertilizers were noticeably lower looking back to last month. DTN designates a significant move as anything 5% or more.

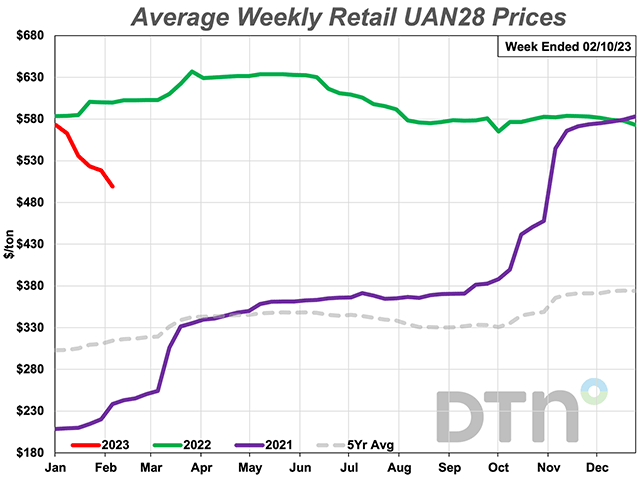

Leading the way lower are UAN32 and UAN28 once again. Both liquid nitrogen fertilizers were 11% lower in price compared to last month. UAN28 had an average price of $499/ton while UAN32 was at $579/ton.

UAN28 is below the $500/ton level for the first time since the fourth week of October 2021. That week the average price was $458/ton.

Potash was 7% less expensive a month with an average price of $694/ton. Urea was 5% lower compared to last month with an average price of $693/ton.

Potash dropped below $700/ton level for the first time since the first week of October 2021. That week potash's price was $675/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Three fertilizers were slightly lower compared to the prior month. DAP had an average price of $840/ton, MAP $857/ton and anhydrous $1,220/ton.

One fertilizer was just slightly higher in price compared to a month earlier. 10-34-0 had an average price of $755/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.75/lb.N, anhydrous $0.74/lb.N, UAN28 $0.89/lb.N and UAN32 $0.90/lb.N.

Wholesale fertilizer prices continue to fall much like retail fertilizer prices. In the DTN Fertilizer Outlook column, author Logan Garcia said nitrogen prices in January have reset with prices falling sharply to open 2023 (https://www.dtnpf.com/…). The fall was attributed to a lack of demand across fertilizer products as well as further reduction in European natural gas prices last month.

The domestic ammonia market has been mostly quiet in January. The local ammonia market is fairly stable ahead of an anticipated price reset, which would arrive in February.

"In the short term, we see the US ammonia market as softer with further price reductions expected before direct application could take off in March/April," Garcia wrote.

The outlook for urea is also softer with the potential to stabilize once buyers return to the market for spring product. The outlook for UAN in the US is stable in the short term, pending further developments in the urea and ammonia markets, which might necessitate further price adjustments again.

All fertilizers are now lower in price compared to a year ago by the following percentages: DAP (4%), MAP (8%), 10-34-0 (9%), potash (15%), both UAN28 and UAN32 (17%), anhydrous (18%) and urea (24%).

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

A North Dakota State University Extension agricultural finance specialist said while fertilizers' prices are not at record high levels they are still above the five-year average. You can read it here: https://www.dtnpf.com/….

| Dry | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Feb 7-11 2022 | 876 | 935 | 815 | 905 |

| Mar 7-11 2022 | 919 | 955 | 822 | 901 |

| Apr 4-8 2022 | 1040 | 1056 | 875 | 1031 |

| May 2-6 2022 | 1057 | 1081 | 881 | 1001 |

| May 30-Jun 3 2022 | 1056 | 1079 | 880 | 979 |

| Jun 27-Jul 1 2022 | 1039 | 1053 | 885 | 867 |

| Jul 25-20 2022 | 1005 | 1041 | 887 | 836 |

| Aug 22-26 2022 | 972 | 1026 | 880 | 804 |

| Sep 19-23 2022 | 950 | 1005 | 875 | 811 |

| Oct 17-21 2022 | 930 | 986 | 863 | 826 |

| Nov 14-18 2022 | 930 | 978 | 848 | 812 |

| Dec 12-Dec 16 2022 | 902 | 939 | 807 | 779 |

| Jan 9-Jan 13 2023 | 868 | 875 | 742 | 732 |

| Feb 6-Feb 10 2023 | 840 | 857 | 694 | 693 |

| Liquid | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Feb 7-11 2022 | 827 | 1487 | 600 | 699 |

| Mar 7-11 2022 | 866 | 1490 | 603 | 704 |

| Apr 4-8 2022 | 901 | 1534 | 629 | 729 |

| May 2-6 2022 | 906 | 1534 | 631 | 730 |

| May 30-Jun 3 2022 | 905 | 1529 | 633 | 731 |

| Jun 27-Jul 1 2022 | 904 | 1466 | 611 | 702 |

| Jul 25-20 2022 | 894 | 1431 | 596 | 693 |

| Aug 22-26 2022 | 869 | 1331 | 575 | 676 |

| Sep 19-23 2022 | 860 | 1376 | 578 | 670 |

| Oct 17-21 2022 | 759 | 1419 | 576 | 678 |

| Nov 14-18 2022 | 753 | 1415 | 584 | 681 |

| Dec 12-Dec 16 2022 | 750 | 1415 | 579 | 682 |

| Jan 9-Jan 13 2023 | 754 | 1245 | 563 | 650 |

| Feb 6-Feb 10 2023 | 755 | 1220 | 499 | 579 |

Russ Quinn can be reached at russ.quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.