DTN Fertilizer Outlook

Nitrogen Fertilizer Wholesale Prices Fall Sharply in January on Lack of Demand, Lower European Natural Gas Prices

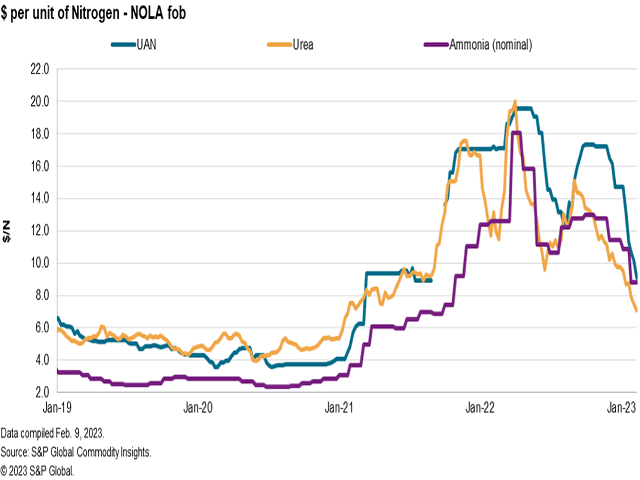

January began a reset across the nitrogen complex with anhydrous ammonia, urea and UAN fertilizer prices falling sharply to open 2023, a fall attributed mostly to a lack of demand across all products as well as further reductions in European natural gas prices last month.

The following is a recap of fertilizer price trends and market developments for the month of January.

AMMONIA

Domestic: Following an expected reduction in the Tampa ammonia settlement for January, the U.S. ammonia market was mostly quiet in January. Some reduced pricing from initial fill offers in December were reported, but overall, the scenario in the local market was one of stability ahead of an anticipated price reset, which would arrive in February.

No major changes were reported on previous Corn Belt prompt offers from December from $950-$1,100 per short ton (t) free-on-board (FOB -- or price per ton of ammonia without transport costs). Much of the country saw spotty precipitation and winter weather in January, precluding much in the way of early season activity even in the southern U.S., including Texas.

Oklahoma factory prices were also reported lower last month at $870-$885/t FOB ex-plant against initial fill offers from $890-$950 in December.

Buyers have remained mostly absent for 2023 so far, content to wait in hopes of lower pricing closer to spring preplant direct application. Sellers in the market have told Fertecon that ammonia prepay sales were rather disappointing compared to previous years, which could also result in greater logistical strain than usual for spring 2023.

In the short term, we see the U.S. ammonia market as soft with further price reductions expected before direct application could take off in March/April.

International: There was a change in tide in the ammonia market in January following a drop in gas prices in Europe. The cost of natural gas in Europe declined in late December and into January, boosting the prospect of an increase in ammonia output in Europe by suggesting a total theoretical cost of production of around $750 per metric ton (mt) in Europe -- far lower than 2022 year-end price levels.

In late January, further guidance emerged from the U.S. Gulf, with Yara and Mosaic settling their monthly supply contract at $790/mt cost-and-freight (CFR -- or sales price plus shipping costs) Tampa for February. The price, down $185 on January, is the lowest level seen at Tampa since October 2021.

The falling prices in the wider ammonia market are further illustrated by Black Sea ammonia, assessed nominally at $770-$820/mt FOB down from highs at $995 in December, and in the Baltic, where prices fell from $872-$907/mt FOB to $730-$775.

The outlook remains soft for the global ammonia market, which is expecting further decreases on recovering natural gas costs in Europe continuing to lower price levels globally.

UREA

Domestic: Urea prices fell sharply during January, reaching near two-year lows at New Orleans, Louisiana, (NOLA) of $340-$390/t FOB during the last week of the month, down from our first assessment of 2023 at $416-$460/t FOB. World demand took a pause as buyers waited for other buyers to emerge in India, and the building supply glut is resulting in more deliveries earmarked to the U.S. is lieu of any other major buyers stepping forward.

Urea offers at terminals on the Mississippi River still open to barging were adjusted lower to $420-$450/t FOB, approximately $100 lower from late 2023 offers.

Market sentiment on urea seems softer ahead of spring demand, along with a building import lineup on the trader side. Further down the supply chain, however, urea remained the cheapest form of nitrogen fertilizer at the price spread before UAN offers fell sharply further in February.

The outlook on urea prices is softer with potential to stabilize once buyers return to the market for spring product. However, the sheer speed and size of price cuts across the nitrogen complex in early February seemed to put the entire market in a state of shock.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Discussions at The Fertilizer Industry (TFI) annual conference in Palm Springs this month will likely be dominated by this new price spread we find ourselves in, and how both buyers and sellers can navigate selling in a falling market with considerable length in domestic supplies.

International: Global urea markets continued to fall across the board in January as weak demand persisted from key markets such as India and Brazil and sellers awaited fresh buying interest in Europe and the U.S. The continued absence of an Indian spot tender put pressure on the trading community, and the free fall in prices continued throughout the month. The month ended with sales activity muted in Asia due to Chinese Lunar New Year celebrations.

On the sellers' side, the picture was not pretty. All major suppliers were long with the fading hope of an Indian tender, leading Egyptian urea prices to fall to $430-$455/mt FOB last month, or about $100-$120 down compared to December.

Urea prices in Brazil fell similarly because of its lackluster demand for urea cargoes in January, settling the month at $400-$420/mt CFR versus $520-$550 at the end of 2022.

With no Indian tender announced in January, fresh hopes are pinned on one in February for March/April shipment. New demand from Brazil along with Europe would be needed to firm up prices heading into spring, which as of now, remain in a falling price scenario.

UAN

As urea prices have continued to plummet in recent months, stagnant UAN values were unable to compete and lost almost all buyer interest for spring against urea to open 2023 as a result. This put downward pressure on the UAN market in the arms race for spring nitrogen buying.

NOLA UAN barges slipped to $335-$350/t FOB by late January, down from $460-$480 at the start of the month.

Eastern Oklahoma factory prices fell as well by about $150/t from $500-$530 FOB from the plant in December to $350-$360 last month.

Cincinnati UAN 32% was offered lower to $400/t FOB to end the month, down from the 2023 opening year price of $460. The lower prices also mirrored the weaker barge prices. Other river hub terminals that were open to barges were priced similarly in a range of $400-$410.

On the U.S. East Coast, the UAN 32% levels moved lower to $420-$470/mt CFR, down from $500-$530 on last spot trades reported prior to the new year break. The region has been an illiquid market of late due to Russian sellers getting better netbacks elsewhere, but price ideas have now aligned more closely with the rest of the country despite slow sales.

Across the January and early February price reductions, it seems UAN has finally been able to achieve a price spread with urea more reflective of historical market conditions, and fears over massive lost acres have mostly subsided as well.

Our outlook on U.S. UAN prices is stable in the short term, pending further developments in the urea and ammonia markets, which might necessitate further price adjustments again.

PHOSPHATES

Domestic: January was a month of split pressure across the phosphate market in the U.S. due to pressure from a greater proportion of MAP versus DAP imports in recent months, as well as the emergence of some early application activity in the Southern Plains, which is primarily a DAP market.

However, demand for phosphates overall was slow, typical for the early year winter period between the fall/winter and spring application windows.

Our NOLA DAP assessment increased from $610-$630/t FOB to $635-$645 through January. In comparison, NOLA MAP barge prices conversely saw a modest $5/t increase on the upper end, assessed at $600-$605 FOB to open the year compared to $600-$610/t FOB at the end of January.

Terminal activity was similarly slow alongside low barge demand. DAP prices gained $5-$10/t over December to $675-$700 FOB, a smaller increase than at the U.S. Gulf due to lower inland demand. MAP offers, meanwhile, fell about $10 to $655-$680 due to the reasons above.

Imports on phosphates are building for the spring season from overseas sellers after the stable-to-higher values were noted, as well as supply concerns considering the various challenges the phosphates market faced in 2022, including low water on the Mississippi River.

Phosphate prices in the U.S. are seen as stable in the short term, with the evolving supply and demand balance to take further shape over the next several weeks.

International: The phosphate market was quiet in January, as Asia and Latin America were out of season, but also because many buyers continued to defer their purchasing decisions, hoping to yield lower prices. This theory was vindicated in most instances, with benchmarks in Russia, North Africa, China and Europe all falling throughout January.

Following several weeks of prices rallying to buck the overall trend, however, the Brazilian MAP market opened 2023 with upward momentum, having ended December at $640-$660/mt CFR but rising to $650-$660 in January. More typical was the scenario seen in India, which in January saw DAP prices end the month at $658-$660/mt CFR, down from $720-$730 in late 2022.

There was little reported buying in European markets, but suppliers' hopes were riding on strong last-minute demand to take prices up. Prospects for Europe were clouded by debt worries and exchange rate fluctuations, but North African and Baltic producers would take heart from continued U.S. dollar weakness.

The resulting divide between markets on either side of the Atlantic leaves our short-term price outlook for global phosphates mixed in the west but weaker in the east.

POTASH

Some potash buying has certainly occurred over the previous fall and winter sales periods, but the question now is when buyers will return for the remaining requirements, and whether U.S. logistics will be in place to meet those needs when the time comes. There is a general sense of oversupply both in the U.S. as well as the rest of the globe, and without much reason to act early, buyers still appeared to be waiting out January in hopes of lower prices.

NOLA granular potash barges were assessed at the end of January at $395/t FOB, falling below $400/t FOB for the first time since June 2021 -- around the time that the U.S., EU, UK and Canada all announced coordinated sanctions on Belarusian potash. The market remains soft following winter-fill offers earlier this month, with the NOLA assessment having fallen nearly $100 from $490 in December.

Halfway through the month, Nutrien released its potash winter-fill offers at $480/t FOB Midwest terminal, $530-$560 Pacific Northwest, and $495 Baltimore in the U.S. Nutrien took orders at these levels for first-quarter delivery and at $40/t premium for delivery in the second quarter, before ending the sales program.

Mosaic also announced an updated price list in mid-January, having offered $475/t FOB river terminal and $480 Midwest inland terminal for shipments through March.

River terminal offer levels continued to fall after the producer sales as supply weighed on prices. Most of the major U.S. sales points fell in line to $460-$485/t FOB -- down from $540-$560/t FOB in December along sections of the river still open to barges.

Potash prices in the U.S. are seen softer to stable in the short term with little new trade developments to speak of in January.

**

Editor's Note: This information was supplied courtesy of Fertecon, S&P Global Commodity Insights, formerly IHS Markit.

**

DTN recently published a series titled "Global Fertilizer Outlook." Here are those articles:

To see Global Fertilizer Outlook - 1, go to: https://www.dtnpf.com/….

To see Global Fertilizer Outlook - 2, go to: https://www.dtnpf.com/….

To see Global Fertilizer Outlook - 3, go to: https://www.dtnpf.com/….

(c) Copyright 2023 DTN, LLC. All rights reserved.