South America Calling

La Nina Weakening Midway Through South American Crop Year

It is the third-straight year of La Nina to begin a new crop season in South America. Typically, La Nina leads to hot and dry conditions for Argentina and southern Brazil as well as a shortened wet season in central Brazil.

These past two La Nina years have had different effects on the crop situation for corn and soybeans in both countries, but have produced widespread weather challenges including extreme and record heat, and widespread record droughts.

The third La Nina is starting a little benign for southern Brazil. Fronts have regularly stalled in the region and produced good rainfall. Soil moisture in this part of the continent is excellent and full-season corn planting has already benefited from the current conditions, though it has been cooler than normal.

In Argentina, the winter has been cold and dry. Late frosts and freezes have likely damaged winter wheat and below-normal temperatures are slowing the rise of soil temperatures, which is pushing back corn planting. The dryness is causing delays as well. In Argentina, corn is planted in two phases, the first in September and October, and the second in December and January. The last two La Ninas pushed a larger portion of the crop into the second phase than normal, and this year is likely to do the same.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In central Brazil, there has yet to be an effect from La Nina. The start of the wet season was delayed by about two weeks two years ago, but last year started on time. Models are pointing to this year starting near normal in late September as well, which is atypical, but would be important for getting the second-season (safrinha) corn crop planted on schedule.

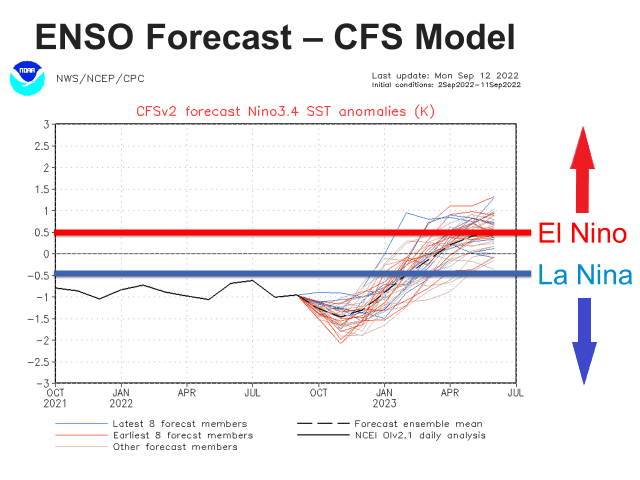

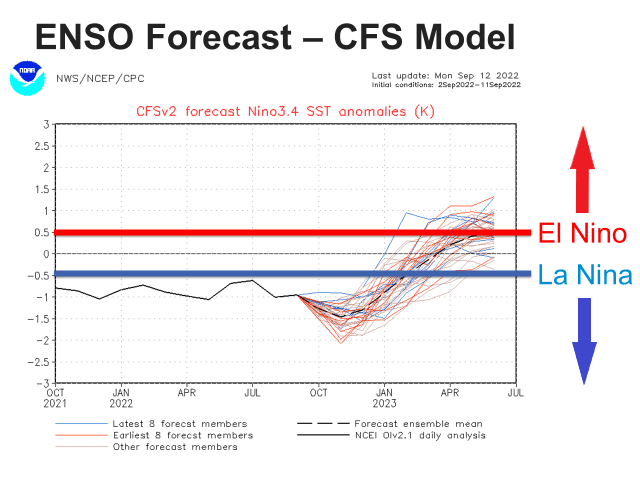

La Nina heat and dryness are forecast through the front half of the growing season. Models are forecasting it to remain relatively stable through the end of the calendar year. But all models suggest a turn toward neutral conditions early in 2023. The American Climate Forecast System (CFS) model turns conditions to a more neutral state in January or February. The European Centre for Medium Range Weather Forecasting (ECMWF) model suggests a similar time frame. The Australian Bureau of Meteorology model suggests early January. The timing may be important, but not for any early planted crops. These will likely undergo the full impact from La Nina.

But when first-crop corn in Brazil and early planted corn in Argentina are finished, the effects for safrinha corn in Brazil, and soybeans and late-planted corn in Argentina are uncertain. The atmosphere typically takes some time to adjust to a change in the ENSO conditions, so effects may wait until February or March to set in. That would keep most of Argentina's crop in the La Nina heat and dryness concerns, especially soybeans. For any crop planted later, a return to generally average conditions would then be expected. However, a strong change in the atmospheric conditions could also lead to wild shifts in the weather as well, which could have negative effects.

For safrinha corn in Brazil, this would likely be a blessing. The wet season usually ends in early May, but La Nina shortens that up by a couple of weeks on average. If La Nina conditions are no longer in place early in the safrinha season, the wet season may turn into an average one. An on-time start combined with a normal wet season would certainly mean good corn growing conditions. Wetter conditions over southern Brazil would also be promising.

In Argentina, the potential for reduced heat and moisture stress would favor any late-planted corn and soybeans, though hangover effects from La Nina may last. The DTN forecast still calls for near- to slightly below-normal rainfall over the country from March through May, but there is a lot of variability that may show up within each month. Variable weather conditions typically do not point toward good yields.

One more La Nina season is being forecast for South America, at least the first half. It remains to be seen if the forecast will hold, and if significant reductions in yields will be noted or not. But we will continue to watch, because as DTN Lead Analyst Todd Hultman noted in our presentation at Husker Harvest Days this week, the world supply situation for all significantly traded grains is extremely tight, and the world is counting on supplies being there from South America. If there are significant production reductions from these countries, the world markets will react strongly.

To find more international weather conditions and your local forecast from DTN, head over to https://www.dtnpf.com/…

John Baranick can be reached at john.baranick@dtn.com

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .