An Urban's Rural View

The Recession Went AWOL; So How Did Inflation Fall?

Here's what's supposed to happen when the Federal Reserve Board raises interest rates. Demand for goods and services drops, unemployment rises and economic growth stalls, throwing the economy into recession. The recession defangs rising prices. Recession -- reflected in high unemployment -- is the mechanism by which higher rates tame inflation.

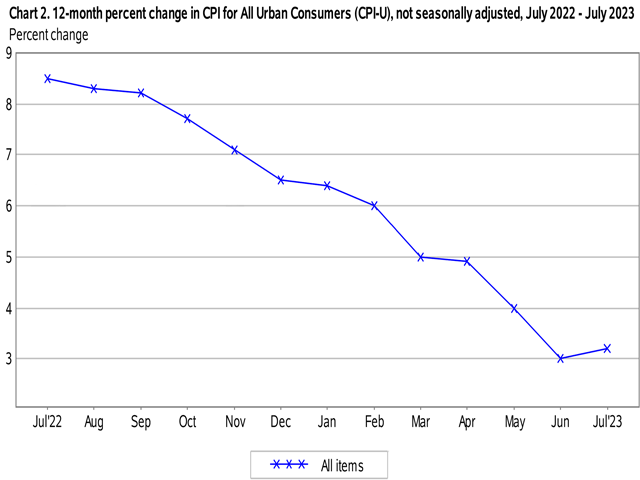

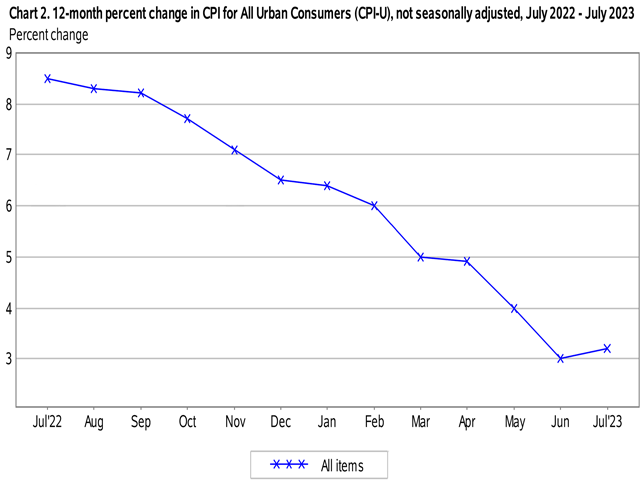

Here's what has actually happened these last 18 months. The Fed has raised interest rates 11 times, a total of five full percentage points. Inflation has come way down from the 9% annual rate it reached at its peak; it's now around 3%, though "core" inflation (minus volatile food and energy prices) is more like 4%. But unemployment is shockingly low -- under 4%. And the economy is still growing.

There's been a disconnect, then, between result -- inflation abating -- and mechanism for achieving the result -- recession not happening. Needless to say, this has caused puzzlement and sparked differences of opinion over what's going on and what the Fed should be doing now.

Two questions are at the center of this debate. Why didn't higher rates cause a recession? And if the recession mechanism didn't work, what did bring interest rates down?

At stake in this debate for farmers and ranchers and other business borrowers is the near-term future of interest rates. Will rates go higher? How long will they stay high?

When the Fed started raising rates, it believed in the mechanism. Again and again Fed chair Jerome Powell warned rate increases would slow the economy. The central bank was so committed to smashing inflation it was willing to see significantly higher unemployment and a recession.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"These are the unfortunate costs of reducing inflation," Powell said in a 2022 speech. "But a failure to restore price stability would mean far greater pain."

So far, though, high interest rates have mainly caused pain for the borrowers who have to pay them. They haven't cost many Americans their jobs. The expected recession has gone AWOL.

Or is it just a little late? One school of thought says a recession is just over the horizon. High interest rates haven't hit home yet but they will.

In support of this school of thought, consider business borrowing. During the pandemic, many companies locked in lower rates for a few years. They haven't been affected by the Fed's rate hikes yet, but those loans will have to be renewed at some point soon at much higher rates. That will take some wind out of the economy's sails.

If this delayed-recession theory turns out to be right, the Fed could be lowering interest rates soon, especially if inflation continues to moderate.

Another school of thought thinks inflation isn't dead; it's just taking a breather. That's what happened in the 1970s. Inflation came down for a while and then picked up and soared even higher. If the Fed decides inflation is alive and well, rates will be headed higher and will stay high longer.

As for how inflation eased without unemployment rising, some offer this theory: Unlike many bouts of inflation, this one was about too few goods, not too much money chasing them. It happened because the pandemic disrupted supply chains, making goods scarce. Once the kinks in the supply chains were worked out, the inflationary engine ran out of fuel.

To put the matter another way, it wasn't mainly the Fed's rate hikes that conquered inflation, though they may have helped. It was the natural unwinding of the unnatural disruption in supply. The unwinding pinch-hit for recession as the alternate mechanism for taming inflation. If the Fed accepts this theory, it will be less inclined to raise rates or keep them high.

Naturally, the Fed hasn't indicated how much -- if at all -- it buys any of these ideas. Fed chair Powell gave a major speech a few weeks ago that sounded hawkish at times and dovish at times.

Today's combination of lower inflation and continued low unemployment makes the Fed even more data dependent than usual. If inflation picks up, or the economy heats up, it will lean hawkish; if unemployment picks up or inflation continues to fall, it will coo like a dove.

If either inflation or unemployment or both stall at their current levels, Fed policymakers are going to have a heck of a debate internally.

The ideal scenario for business borrowers is inflation continuing to ease, allowing the Fed to declare victory and start lowering rates. If you're trying to guess the interest rate the bank will charge you next spring, keep a close eye on the inflation statistics the government churns out in the months ahead.

Urban Lehner can be reached at urbanize@gmail.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .