An Urban's Rural View

Fed Slows Rate Hikes but Signals More to Come

To anyone wondering how high interest rates will go and when they will start coming down, the Federal Reserve has just provided an answer: "We still don't know."

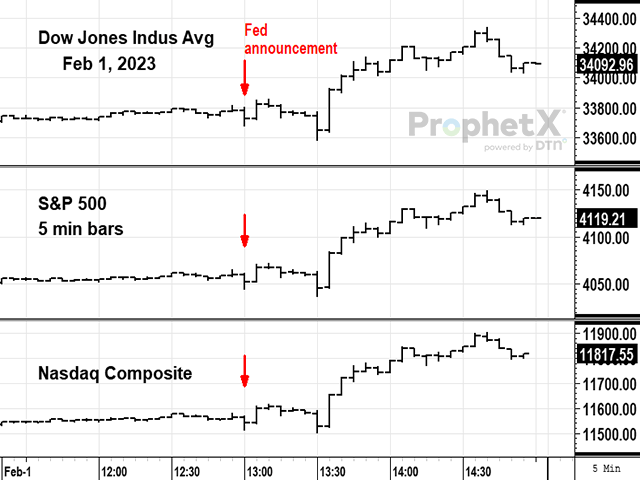

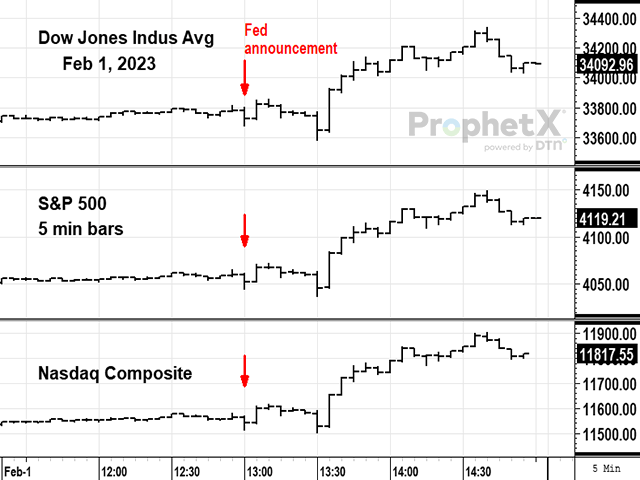

That's the real meaning of the quarter-point interest rate increase the Fed has just announced and the signals it sent in making the announcement. (https://www.federalreserve.gov/…) Financial markets read those signals as suggesting there will be at most one more increase but the markets have long had a more optimistic view of the inflation outlook than the Fed.

I read the signals as a straddle, an admission that there's evidence supporting both sides of the debate between inflation hawks and doves. The Fed always says it's "data dependent" but this time it seems truer than ever. We won't get a definitive answer from the Fed until it has seen more evidence of inflation coming down and the labor market becoming less tight.

In their last three meetings, Fed policymakers have gone from raising the benchmark Fed funds rate by 0.75% to raising it by 0.5% and now by 0.25%, to a current target range of 4 1/2% to 4 3/4%. But that doesn't mean zero is the next move.

The Fed's statement talks of "ongoing increases," a key signal suggesting there will be at least one more increase and in my view probably at least two. The markets think the next one will be the last. Market analysts are talking of "one and done."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The Fed stressed it's "strongly committed" to its objective of reducing inflation to 2%. While the Fed has seen a few months of slowing inflation, price increases are still well over 4% as measured by the Fed's preferred inflation gauge.

Financial markets and monetary-policy doves are confident rates will continue to come down. Many in the markets think that by the end of the year the Fed will be cutting rates.

At his post-announcement press conference, Fed chair Jay Powell conceded that "disinflation" is occurring but said we're in the early stages of it. He suggested that if the Fed were to err, it would err on the side of raising rates too much rather than too little. "We're going to be cautious about declaring victory and sending signals that we think the game is won," he said.

The main reason for caution seems to be the continued strength of the labor market. In its statement, the Fed noted that "Job gains have been robust in recent months, and the unemployment rate has remained low." Powell said there are 1.9 jobs available for every American looking for work.

The fear is that in a labor market that strong wages will rise rapidly, forcing employers to raise product prices in a classic "wage-price" spiral. Powell said there's no sign of such a spiral yet but once one starts it may be too late to stop it.

Monetary-policy hawks think the Fed remains behind the curve. In a January 29 Wall Street Journal op-ed, two former Fed regional-bank presidents indicated that under their "rule-based" approach to Fed policy, a continuation of current levels of inflation would justify a funds rate between 6.5% and 8%. (https://www.wsj.com/…)

It seems to me that with the quarter-point increase, the Fed has avoided taking sides in the debate between those who are convinced inflation will keep coming down and those who worry about the tight labor market. There's data supporting both sides now. Small increases buy time to see more data with minimal harm to the economy.

The interesting question is what the Fed will do if new data support both sides -- inflation keeps coming down but remains above 2%, and the labor market continues tight.

"We still don't know" isn't a very satisfying answer. But for farmers and ranchers and other business borrowers, it's not the worst possible one. There's still hope that the next several months of data will prove the markets and the doves right.

Urban Lehner can be reached at urbanize@gmail.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .