Technically Speaking

Technical Look at New-Crop Corn, Soybean Prices

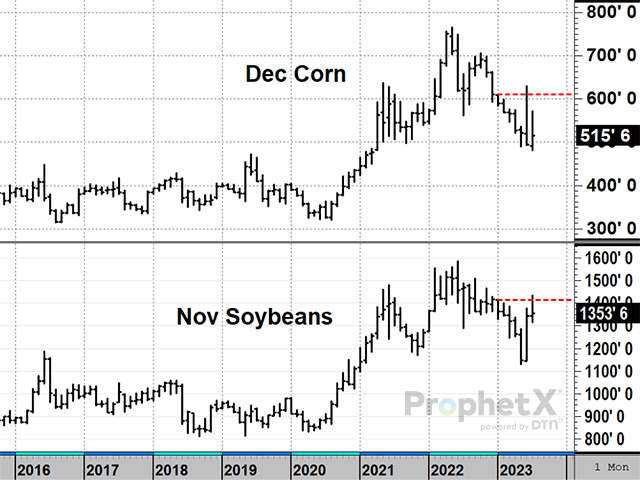

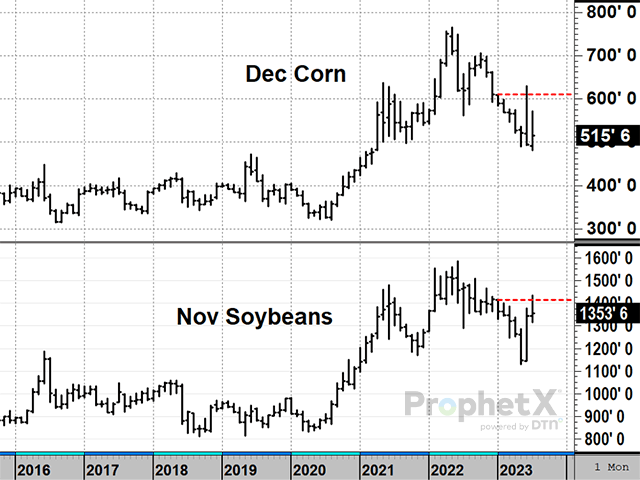

December corn started with a bullish bang last Monday, July 24, responding to news of Russia's attack on Ukraine's port of Reni and the anticipation of a hot week ahead for most of the Midwest. Four lower closes later, December corn was down 6 cents on the week, finishing at $5.30 1/4 Friday, back below the 100-day average at $5.42. The quick reversal to a lower close was not only disappointing for bulls, it left specs hanging with 70,476 net longs as of July 25, when prices were still near their highs, positions that are now under pressure to liquidate. The forecast expects broad coverage of light to moderate rains across much of the Corn Belt this week and more of the same the second week, more favorable for crops. With 94.1 million acres of estimated corn plantings, December corn prices are getting closer to challenging their lowest prices of the year. Trading has been volatile this summer and the trend is officially sideways, but shorter-term momentum has turned down.

SOYBEANS:November soybeans also posted a bearish reversal in the week ended July 28, 2023, closing up 22 3/4 cents at a new 2023 high Monday, but then lost 19 1/4 cents on the week to finish at $13.82 1/2 on Friday afternoon. Unlike corn, soybean prices have a better argument for support from USDA's low planting estimate of 83.5 million acres and from strong domestic demand for soy products. Technically speaking, last week's bearish reversal signals resistance near the high at $14.35 and noncommercials are somewhat vulnerable with 134,982 net longs as of July 25. Trading lower early Monday, the trend remains up and prices are above the 100-day average at $12.92, but short-term momentum has turned down with the wetter forecast for early August. Prices could soon test support near the one-month low at $13.15.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .