Technically Speaking

Soybean Oil and Soybeans Lead The Pack In June

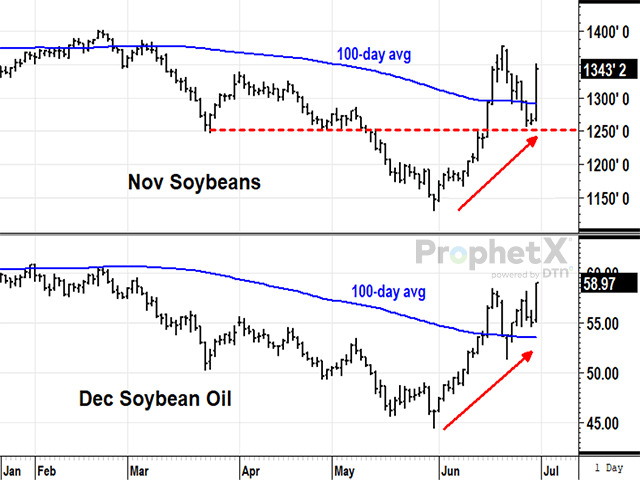

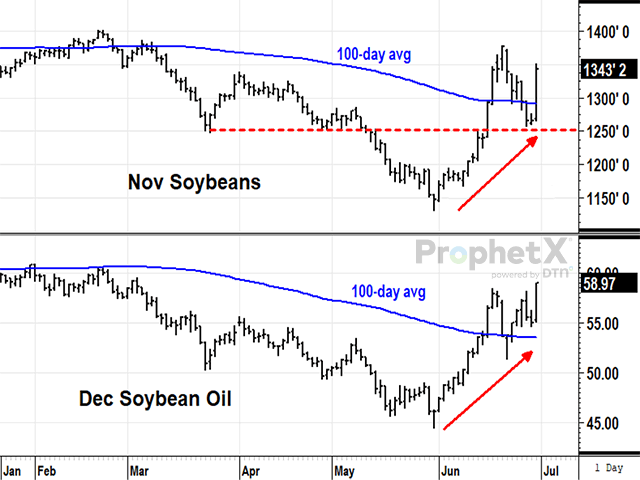

Not only did November soybeans close up 77 1/2 cents at $13.43 1/4 on Friday after USDA estimated lower-than-expected plantings of 83.5 million acres, the contract was up $1.96 3/4 in the month of June, the second most bullish performance in the grain-related sector, behind only soybean oil. In Wednesday's USDA Reports Preview on DTN ( https://www.dtnpf.com/… ), I mentioned soybeans' higher cash prices as a possible hint June 1 soybean stocks would be bullish. But it was the low planting estimate that held Friday's bullish surprise. Technically, November soybeans closed above its one-month high on June 15 and was above the 100-day average the next day. When the forecasts turned wetter after June 21, prices fell back below the 100-day average, but the trend stayed up as prices were still above the previous breakout level near $12.50. Friday's close at $13.43 1/4 is back above the 100-day average and the trend remains clearly up.

SOYBEAN OIL:The quiet bullish winner for the month of June in the grain-related sector is soybean oil with a 33% gain in the August contract and a 28% gain in the December contract. Soybean oil also led the performance of other vegetable oils as it was the first to close above its 100-day average on June 15, followed by palm oil a day later. The limit-up close on June 30 in December soybean oil at 58.97 is the highest in over three months and makes a strong case for higher bean oil prices ahead. One of the surprises here is that on June 21, the Environmental Protection Agency (EPA) slowed future expansion of renewable diesel production with low mandates, but it did not discourage the use of soybean oil in 2023. Technically speaking, the seven-month downtrend in December soybean oil turned higher on June 15 after prices broke a new one-month high and closed above the 100-day average at 54 cents. Now at a new-three month high, the trend in December soybean oil is clearly up, also supported by smaller-than-expected plantings of soybeans.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .